How to Trade Tokenized Stocks: A Complete Beginner’s Guide to On-Chain Equities

How to Trade Tokenized Stocks has become a key question for investors entering the world of on-chain finance. As tokenized equities and RWA stocks grow rapidly across global markets, trading them on blockchain networks is becoming easier, faster, and more accessible for retail and institutions alike.

These digital versions of real-world shares allow people around the world to access U.S. equities, indices, and even commodities without traditional brokerage accounts. They offer 24/7 trading, fractional ownership, faster settlement, and the ability to hold assets in full self-custody.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

What Are Tokenized Stocks?

Tokenized stocks—sometimes called tokenized shares or on-chain equities—are digital representations of real-world equities issued through a blockchain. These tokens are backed by, or directly linked to, actual shares such as Apple (AAPL), Tesla (TSLA), or ETFs like the S&P 500.

Using blockchain-based tokenization, issuers convert real-world stocks into cryptocurrency-like tokens that mirror their price. Tokenized stocks aim to offer:

- Faster settlement

- Lower barriers to entry

- Global access

- Self-custody

- Transparent on-chain ownership

They function through different stock tokenization models, primarily wrapped securities and natively issued securities, each influencing price behavior and liquidity.

What is Real-World Assets (RWA)?

Real-World Assets (RWAs) are physical or traditional financial assets—equities, bonds, real estate, commodities—brought onto the blockchain through tokenization. RWAs allow investors to participate directly in traditionally restricted financial markets with improved efficiency and transparency.

Read more: What Are Real-World Assets (RWAs): A Complete Guide To Asset Tokenization

What Are the Pros and Cons of Trading Tokenized Stocks?

Tokenized stocks introduce huge opportunities—but also unique risks that every beginner should understand before buying or selling. While these digital versions of real equities unlock global market access, faster settlement, and fractional investing, they also come with regulatory, liquidity, and tracking challenges that traditional brokerages typically manage behind the scenes. Below is a complete breakdown of the advantages and limitations of trading tokenized stocks.

Pros / Advantages

| Pros / Advantages | Description |

| Fractional Ownership | Buy small fractions of high-priced assets like Berkshire Hathaway or Nvidia without full capital. |

| 24/7 Global Trading | Tokenized equities trade around the clock, unlike traditional stock exchanges. |

| Faster Settlement (T+0) | Near-instant blockchain settlement reduces counterparty risk and improves liquidity. |

| Self-Custody and Transparency | Hold tokenized shares directly in a Web3 wallet with transparent on-chain records. |

| Easy Cross-Border Access | No brokerage accounts, identity restrictions, or regional barriers needed. |

Cons / Limitations

| Cons / Limitations | Description |

| Regulatory Uncertainty | Regulations vary by country; some regions restrict tokenized stock trading. |

| Liquidity Variability | Liquidity differs depending on issuer, blockchain, and market demand. |

| Price Tracking Differences | Tokenized prices may diverge due to oracle delays, spreads, or market friction. |

| Redemption Restrictions | Many issuers do not allow redemption into the real underlying stock. |

Read more: On-chain RWA Market 2025: Growth, Risks, and Investment Opportunities

How Tokenized Stocks Work on the Blockchain?

Tokenized stocks mirror real-world equities using on-chain systems that manage supply, redemption, dividends, price tracking, and settlement.

There are two primary stock tokenization models:

What Are Wrapped Securities in Tokenized Stocks?

Wrapped securities are tokens backed 1:1 by real-world stocks held by a custodian or SPV. The issuer holds the underlying asset, while users trade the digital wrapper.

Key characteristics:

- Backed by real shares

- Price mirrors the underlying with small variations

- Dividends handled via reinvestment or token supply adjustment

- Widely used by platforms like Backed and Ondo

Wrapped securities are the dominant model for RWA trading today because they scale quickly and require less regulatory complexity.

What Are Natively Issued Securities and How Do They Work?

Natively issued securities are created directly on the blockchain as official share units, not “wrapped” versions.

Key characteristics:

- Legally recognized as real shares

- Transparent settlement and corporate actions

- Strong price parity with underlying equity

- Supported by regulated transfer agents

This model represents the future of on-chain equities, with Nasdaq and DTCC testing blockchain-based settlement infrastructure.

Read more: What is Tokenized Stock? A Complete Guide

Why Trade Tokenized Assets and What Benefits Do They Offer?

Tokenized assets make it easier to trade tokenized assets, buy tokenized stocks, and sell tokenized stocks with the help of fractional ownership, 24/7 market access, faster settlement, global availability, and enhanced transparency. Tokenized markets allow both retail and institutional investors to participate more efficiently in global equity exposure.

How Does Fractionalization Make It Easier to Buy Tokenized Stocks?

Fractionalization allows investors to purchase small portions of high-priced equities, removing the financial barriers that prevent many retail users from accessing premium stocks. Instead of needing thousands of dollars to buy a single share, tokenized stocks break assets into tiny units—making portfolio diversification easier, more precise, and more inclusive for global audiences.

How Does 24/7 Trading Improve Accessibility?

Traditional stock markets operate within limited trading hours, but tokenized stocks trade 24/7 across blockchain networks. This continuous availability empowers users in any region or time zone to react instantly to news, market events, or price shifts, ensuring equal opportunity and uninterrupted market participation.

How Do Liquidity and Faster Settlement Help Traders?

Tokenized stocks settle in real time (T+0), enabling users to sell tokenized stocks instantly and reuse capital immediately. Faster settlement reduces counterparty risk and improves overall market efficiency, while on-chain liquidity pools make buying and selling smoother—even during high-volatility periods.

Why Does Global Access Matter for Retail Investors?

Tokenized stocks remove the need for regional brokerage accounts, lengthy identity verification, or geographic restrictions. Anyone with a Web3 wallet can access global equity markets, making it easier for retail investors in underserved regions to invest in leading U.S. stocks and major RWAs without bureaucratic limitations.

How Does Self-Custody Improve Transparency and Control?

Self-custody gives users complete control over their tokenized shares. Instead of relying on centralized intermediaries, blockchain-based ownership provides verifiable, tamper-proof records. This improves transparency, enhances asset security, and allows investors to manage their holdings independently.

What Additional Advantages Do Institutions Receive?

Institutions benefit from tokenized stocks through automated reporting, streamlined settlement, and real-time data visibility. On-chain systems reduce operational costs, eliminate reconciliation errors, and enable faster, more accurate balance sheet updates—making tokenization especially attractive for asset managers, hedge funds, and financial service providers.

Read more: What Is Asset Tokenization and Its Impact on Global Investors?

What Affects Tokenized Stock Prices and What Traders Should Know Before Buying or Selling?

Tokenized stock prices often mirror traditional equities, but on-chain markets can introduce unique dynamics that affect how these assets behave. Understanding what affects tokenized stock prices is essential for anyone planning to trade them, especially since blockchain conditions, issuer mechanisms, and liquidity factors can all influence short-term price movements. Below are the core elements traders should understand when evaluating how tokenized stocks track real stock prices.

Oracle Price Tracking

Tokenized stocks rely on decentralized oracles to pull price data from traditional markets. During periods of high volatility or heavy trading activity, oracle updates may temporarily lag. This delay can cause tokenized stock prices to drift slightly from their underlying real-world prices until the next oracle update corrects the gap.

Liquidity Conditions

On-chain liquidity varies across issuers, trading platforms, and blockchain networks. When liquidity is low, spreads widen and traders may face higher slippage. Robust liquidity pools allow tokenized stocks to align more closely with real-time equity prices, while thin liquidity can create short-lived price dislocations.

Dividends on Tokenized Stocks

Dividends impact tokenized stock pricing differently depending on the issuer:

- Some increase your token balance to reflect dividend payouts.

- Others adjust the token’s internal value (total return model).

These dividend mechanisms can influence how tokenized stocks appreciate over time and may create subtle price differences compared to traditional shares.

Premiums and Discounts

Since tokenized stocks trade on decentralized markets, they may temporarily exhibit premiums or discounts relative to their underlying assets. This can be due to limited liquidity, trading demand, oracle timing, or differences in how after-hours events are priced before traditional exchanges open. These variances typically normalize as liquidity returns or oracle updates occur.

Step-by-Step Guide: How to Trade Tokenized Stocks

This walkthrough covers How to buy tokenized stocks, how to sell tokenized stocks, and complete step-by-step tokenized stock trading for beginners.

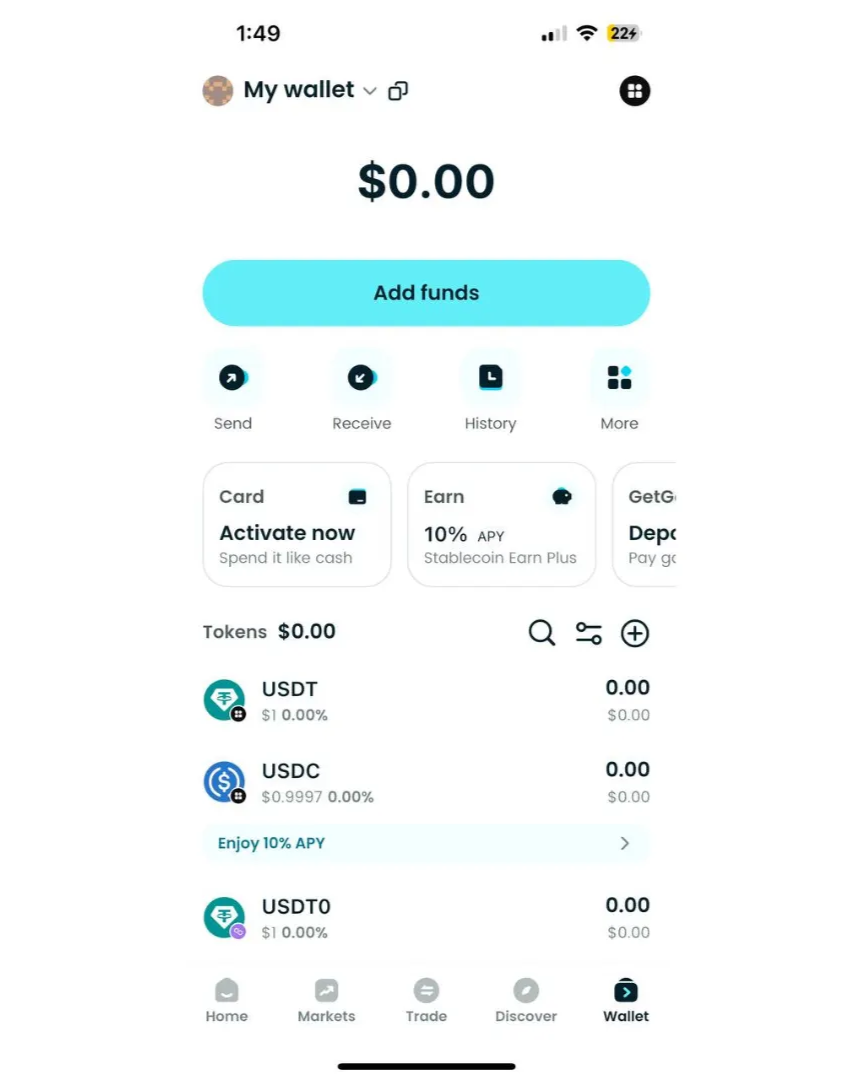

Step 1 — Set Up Your Bitget Wallet

Create your Bitget Wallet, back up your seed phrase, and get it ready for trading. This wallet lets you trade tokenized stocks on Bitget Wallet securely.

Step 2 — Deposit Funds for RWA Trading

Add USDC, USDT, SOL, or ETH to your wallet. Keep some native tokens for gas fees.

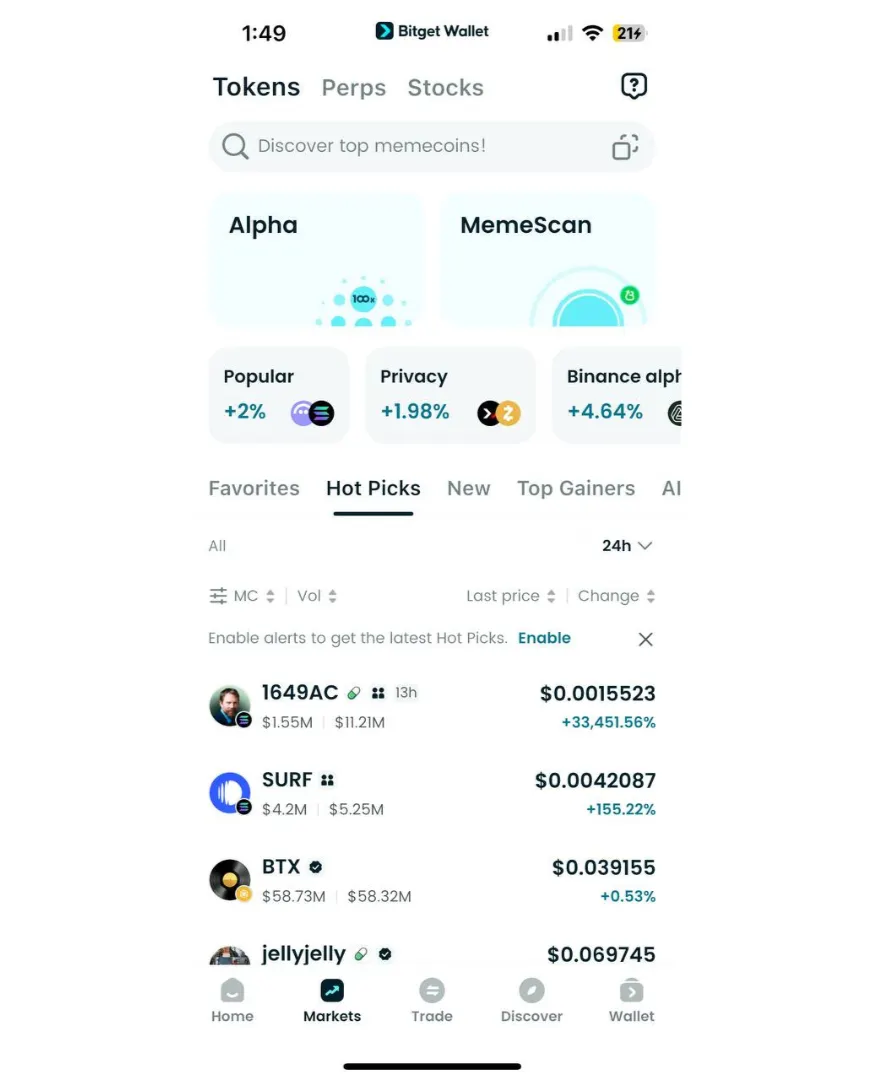

Step 3 — Browse and Select Tokenized Shares

Go to the Explore tab to find available tokenized shares, trending RWAs, and major U.S. equities.

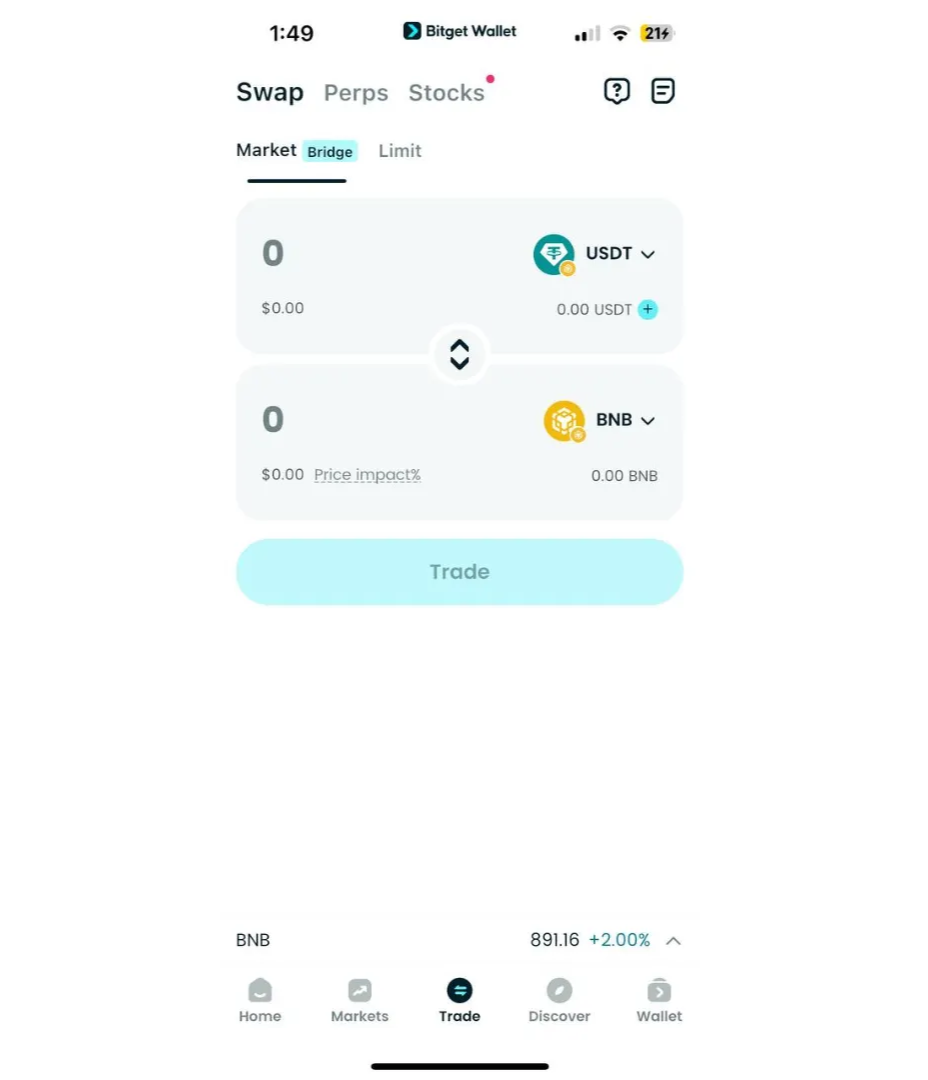

Step 4 — Execute Your Trade (Buy or Sell Tokenized Stocks)

Choose the tokenized stock you want, confirm the amount, and complete the trade. Settlement happens within seconds.

Step 5 — Manage Self-Custody and Portfolio Tracking

Track your tokenized stocks directly inside Bitget Wallet, monitor performance, and manage your holdings with full on-chain transparency.

How to Trade RWA Stocks On-Chain Safely?

Trading RWA stocks on-chain requires understanding how on-chain markets differ from traditional finance. Follow these key safety practices to protect your funds and make informed decisions:

- Know the difference between 24/7 crypto trading and traditional market hours, as price behavior can vary significantly when real markets are closed.

- Verify issuer credibility, including custody arrangements, audits, and whether the token is backed 1:1 by real equities.

- Understand the exposure type—synthetic models behave differently from wrapped, asset-backed models.

- Monitor oracle updates and liquidity levels, which can affect how quickly tokenized stocks track real stock prices.

- Only interact with verified contract addresses, ensuring you avoid phishing, fake tokens, or malicious smart contracts.

Why Traders Choose Bitget Wallet

Traders prefer Bitget Wallet because it provides a secure, seamless, and feature-rich environment for managing tokenized assets and RWAs. Its advanced tools and optimized trading flow make it one of the leading platforms for Bitget tokenized stock trading.

Key advantages include:

- Multi-chain support for effortless access to assets across major networks

- Aggregated liquidity to ensure competitive pricing and smoother execution

- Dedicated RWA integrations, offering powerful Bitget RWA features

- User-friendly trading tools for both beginners and advanced users

- Strong self-custody protection, giving traders full control over their holdings

Read more: What is xStocks and How to Trade Tokenized U.S. Stocks on Bitget Wallet?

CONCLUSION

How to Trade Tokenized Stocks is increasingly important as investors look for faster, more accessible ways to participate in global markets. Tokenized equities combine the benefits of blockchain—fractional ownership, 24/7 trading, and instant settlement—with the familiarity of traditional stocks, making them a powerful entry point into the RWA ecosystem.

By understanding how tokenized stocks work and how on-chain markets behave, traders can navigate this new asset class with confidence. With secure self-custody, multi-chain support, and optimized trading tools, Bitget Wallet provides one of the best environments for exploring tokenized assets safely and efficiently.

From stable savings to trending trades, Bitget Wallet makes it simple for beginners.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1: How to Trade Tokenized Stocks if I’m a Beginner?

To get started, create a Web3 wallet such as Bitget Wallet, deposit supported assets (USDC, USDT, SOL, or ETH), and browse available tokenized stocks. Select the asset you want, review the price and liquidity, and confirm your trade. Because trades settle on-chain, your tokens appear in your wallet within seconds, making the process simple even for first-time users.

2: Are Tokenized Stocks the Same as Real Equities?

Tokenized stocks are designed to mirror the price of real equities and provide similar economic exposure. However, they usually do not include shareholder voting rights, direct legal ownership, or participation in company governance. Instead, they function as digital representations managed by issuers who hold or track the underlying asset. This makes them easier to trade globally, but with different rights compared to traditional shares.

3: How Do Dividends Work in Tokenized Stocks?

Dividends depend entirely on the issuer’s model. Some issuers increase your token balance when dividends are paid, while others adjust the token’s internal value to reflect total return. This ensures the economic benefit is passed on, even if the payment method differs from traditional cash dividends. Always check the issuer’s documentation to understand how dividends are distributed for the specific token you hold.

4: What Are the Risks When You Buy or Sell Tokenized Stocks?

The main risks to consider include low liquidity, which can widen spreads or cause slippage; oracle price delays, which may temporarily cause price gaps; and issuer-related risks such as custody transparency and regulatory compliance. Tokenized stocks may also behave differently from traditional equities during high volatility, so traders should review liquidity pools, issuer credibility, and trading hours before making decisions.

5: Do Tokenized Shares Always Match Real Stock Prices?

Tokenized stocks typically track their underlying equities closely, but temporary price differences can occur. Factors such as liquidity depth, oracle update frequency, dividend adjustments, and 24/7 trading activity all influence short-term movements. These divergences are normal and often correct themselves as liquidity improves or oracles update to the latest market data.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.