Theoriq (THQ) Listing Launch Date: Inside the AI Agent Coordination Layer Powering Web3 Networks

Theoriq (THQ) Coinbase listing is generating excitement in the crypto world, sparking speculation about its potential to be the next major AI-infrastructure success. Not long ago, early investors in AI-focused tokens like Fetch.ai (FET) benefited significantly as the AI narrative accelerated across Web3 markets. Now, another potential game-changer is entering the spotlight — Theoriq (THQ).

Set to potentially list on Coinbase, Theoriq (THQ) is an AI agent coordination and orchestration token designed to support decentralized, on-chain intelligence across DeFi and Web3 applications, and it is already creating buzz among traders and analysts. Will this be another success story in the making? In this article, we dive deep into what makes Theoriq (THQ) stand out, how to trade it once available, and why investors are keeping a close eye on its launch and possible exchange listings. For those preparing to participate early, Bitget Wallet provides a reliable entry point with secure stablecoin storage, access to hot memecoin trading, and a seamless cross-chain experience—all within a non-custodial, user-friendly wallet.

Theoriq (THQ) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the Theoriq (THQ) listing:

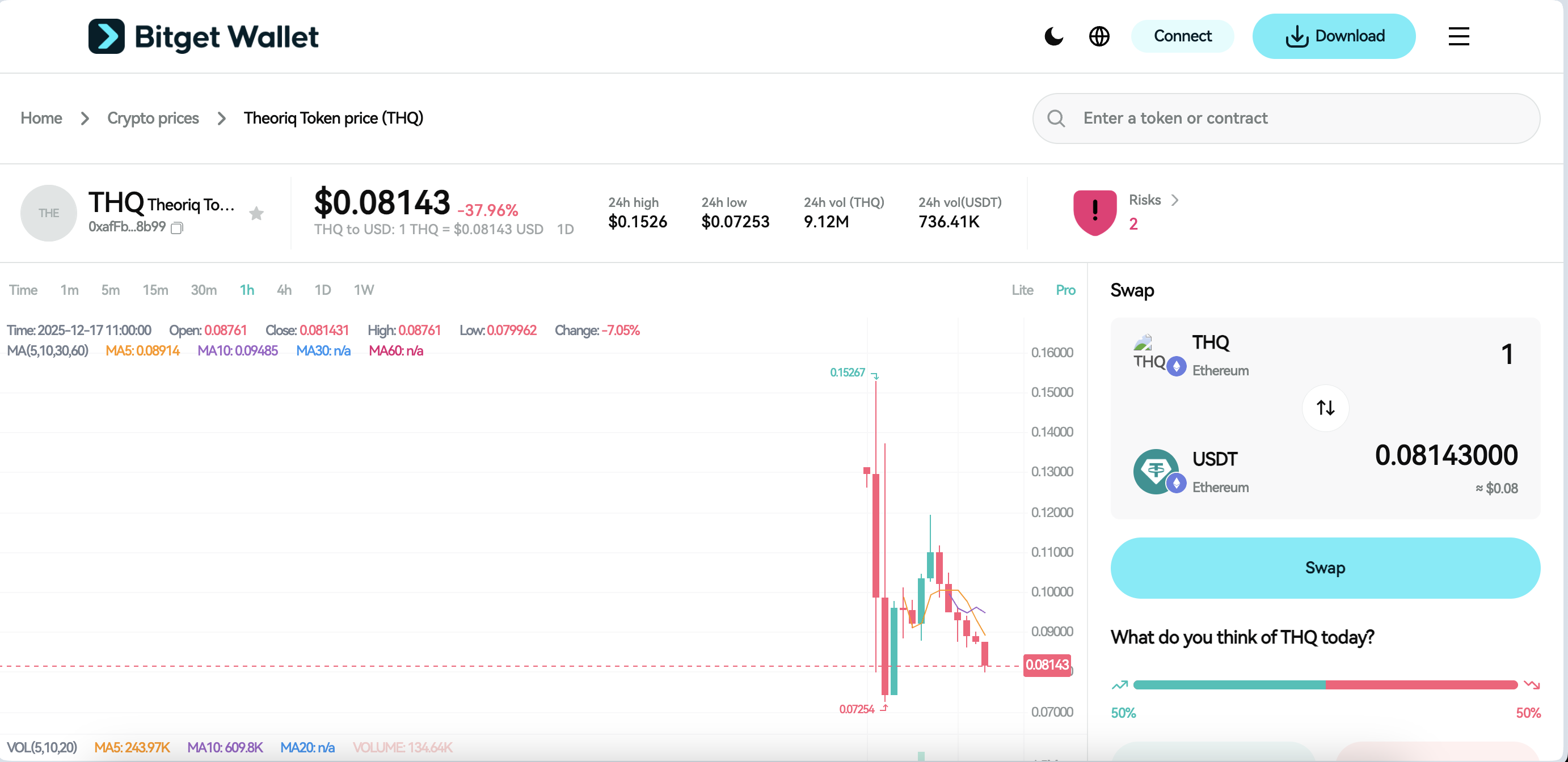

- Exchange: Coinbase

- Trading Pair: THQ/USDT

- Deposit Available: Dec 17, 2025

- Trading Start: Dec 17, 2025

- Withdrawal Available: Dec 18, 2025

Don’t miss your chance to start trading Theoriq (THQ) on Coinbase and be part of this groundbreaking journey.

- Please refer to the official Coinbase announcement for the most accurate schedule.

Which Is Better: Crypto Exchange or Crypto Wallet Trading?

If you want full control of your assets and maximum earning power, choose Bitget Wallet. Unlike crypto exchanges where funds remain in custody, Bitget Wallet is self-custodial, giving you security, privacy, and direct access to DeFi.

Bitget Wallet Key Advantages:

✅ Stablecoin Earn Plus: Earn up to 18% APY on your holdings

✅ Zero-fee trading on memecoins and RWA U.S. stock tokens

✅ Crypto card with Mastercard & Visa: Spend globally with zero fees

Add to that instant cross-chain swaps across Solana, Ethereum, and BNB, and you’ll see why many users combine both worlds — trading early and fee-free with Bitget Wallet, then using CEXs for bulk orders.

👉 For autonomy, yield, and zero fees, Bitget Wallet gives you the edge.

Theoriq (THQ) Price Prediction: Market Maker Impact

The listing of Theoriq (THQ) on Coinbase is not just a retail trading event—it is also a critical phase for institutional liquidity providers and market makers. While Coinbase has not publicly disclosed the specific market makers supporting THQ, major centralized exchanges typically rely on established firms such as Wintermute, GSR, or similar institutional liquidity providers to facilitate orderly markets. These firms have historically exhibited active spread management and short-term inventory rebalancing, making this an event to watch closely.

Given Theoriq’s positioning within the AI agent coordination and Web3 infrastructure narrative, early trading behavior is expected to mirror patterns seen in comparable AI tokens during major CEX listings, where volatility is elevated during initial price discovery.

Key Market Maker Indicators

-

Market Maker Roster & Strategy:

Although no official market maker has been named for THQ, institutional liquidity providers operating on Coinbase typically deploy short-term, high-frequency market-making strategies in the early stages of a listing. This approach often results in sharp intraday price movements as liquidity providers rebalance exposure.

-

Liquidity Pool Size at Launch:

A relatively large initial liquidity pool is expected for Coinbase listings, suggesting lower difficulty in direct price manipulation, though demand spikes can still trigger rapid price expansions similar to those observed in early Coinbase listings of AI-related tokens.

-

Market Maker Contract Expiry & Options Open Interest:

At the time of writing, no Deribit options data or disclosed market-making contract expiry information exists for THQ. As with similar early-stage tokens, derivatives markets are expected to form only after sustained spot-market activity.

Price Projection Based on Market Maker Activity

| Time Frame | Predicted Price Range | Market Maker Influence |

| Short-term (1–3 months) | $0.25 – $0.60 | High volatility expected during early price discovery and liquidity rebalancing |

| Medium-term (3–6 months) | $0.50 – $1.20 | Potential stabilization as market makers normalize spreads and volume increases |

| Long-term (1 year or more) | $1.50 – $3.00 | Project fundamentals, AI adoption, and broader market cycles take over |

Fear & Greed Narrative:

🚨 “As institutional liquidity providers adjust positions following the Coinbase listing, THQ may experience rapid price fluctuations similar to early-stage AI tokens during their first major exchange debut.”

Source: CoinMarketCap, CoinGecko, Messari

Note: The price ranges above are derived from comparative performance of similar AI-focused and infrastructure tokens at comparable stages of market maturity and are provided for reference only. They do not represent the official stance of Theoriq or Bitget Wallet. Please conduct your own research and consult official exchange data before making any investment decisions.

Source: Bitget Wallet

What Is Theoriq: $THQ Token Explained

Theoriq (THQ) is a decentralized AI agent coordination protocol that combines on-chain infrastructure with incentive-driven collaboration to enable intelligent agents to work together across Web3 environments. The project aims to provide a foundational coordination layer for AI agents, allowing them to execute tasks, share information, and align incentives across DeFi, data, and decentralized applications—bridging the gap between isolated AI automation and scalable on-chain intelligence.

Key features

-

AI agent coordination layer:

Theoriq enables multiple AI agents—autonomous or human-guided—to collaborate and perform complex workflows on-chain.

-

Utility-driven token model:

The $THQ token is used for incentives, participation, and coordination within the ecosystem, tying token value to real protocol activity.

-

Cross-Web3 applicability:

Designed as infrastructure rather than a single application, Theoriq can support use cases across DeFi, data markets, and decentralized services.

Source: X

Theoriq (THQ) has recently gained increased attention following announcements around broader exchange availability, including plans by Coinbase to support THQ pending liquidity conditions, alongside growing interest in AI-agent infrastructure within Web3. As the AI narrative continues to expand across crypto markets, Theoriq is being closely watched as a potential foundational coordination layer for decentralized, agent-driven applications, with its Coinbase listing acting as a key catalyst for visibility and adoption.

The Theoriq (THQ) Ecosystem: How It Functions?

Theoriq is a decentralized Web3 infrastructure protocol designed to empower users, developers, and AI agents through on-chain coordination, smart contract automation, and token-based incentives. Rather than operating as a traditional DeFi application, Theoriq functions as a coordination layer that enables intelligent agents to collaborate, execute tasks, and align incentives across decentralized environments.

By leveraging blockchain technology, Theoriq enables seamless interactions such as agent coordination, protocol participation, and governance alignment, all powered by the $THQ token. Below is a step-by-step overview of how the Theoriq ecosystem works:

| Step | Process | Benefit |

| 1. Blockchain Integration | Theoriq operates through on-chain smart contracts on blockchain infrastructure, ensuring transparent and decentralized coordination. | Secure, trust-minimized execution of agent interactions |

| 2. Token Transactions | Users and agents use $THQ for participation, coordination incentives, and ecosystem access. | Aligns incentives between agents, users, and contributors |

| 3. Smart Contracts | Automates agent coordination, task execution, and reward distribution across the network. | Improves efficiency and reduces reliance on centralized control |

| 4. Governance Participation | $THQ holders can participate in protocol governance, influencing upgrades and ecosystem parameters. | Community-driven evolution of the protocol |

| 5. Incentives & Participation Rewards | Contributors and agents earn rewards for meaningful participation and coordination within the network. | Encourages long-term engagement and ecosystem growth |

Meet the Team Behind Theoriq (THQ): Leadership and Strategy

Leadership

The leadership behind Theoriq (THQ) focuses on a long-term, infrastructure-first vision aimed at enabling scalable coordination for AI agents across Web3. Rather than emphasizing individual figureheads, Theoriq’s leadership prioritizes technical governance, sustainable protocol design, and ecosystem alignment, ensuring that development decisions support decentralization and real utility. This leadership philosophy positions Theoriq to grow as a foundational coordination layer, guided by strategic oversight and community-driven evolution rather than short-term market trends.

Strategy

Theoriq’s strategy centers on building a scalable coordination layer for AI agents, rather than competing directly with end-user applications. By focusing on infrastructure, the project aims to enable developers, agents, and protocols to build on top of Theoriq without being locked into a single use case.

Key strategic pillars include:

- Infrastructure-first development: Prioritizing robust coordination mechanisms over short-term feature expansion

- Ecosystem growth: Encouraging third-party developers and agents to integrate with Theoriq

- Token-aligned incentives: Using $THQ to align participation, contribution, and long-term network health

- Gradual decentralization: Expanding governance and community involvement as the protocol matures

This leadership and strategy combination positions Theoriq (THQ) as a long-term infrastructure project designed to evolve alongside the broader AI and Web3 ecosystems.

Theoriq (THQ): Practical Applications & Use Cases

Why Utility Matters for Theoriq (THQ)

Utility is central to Theoriq’s value proposition because $THQ is directly tied to on-chain coordination and participation, not just speculation. As an AI agent coordination protocol, Theoriq relies on $THQ to align incentives between agents, users, and contributors, ensuring that meaningful activity—such as task execution, collaboration, and governance—drives token demand. This utility-first design helps position THQ as an infrastructure token whose relevance scales with real network usage rather than short-term market cycles.

Key Use Cases of Theoriq (THQ)

Theoriq enables a range of practical use cases centered on AI-driven coordination in Web3, including:

- AI agent coordination: $THQ is used to incentivize and manage collaboration between multiple AI agents performing complex on-chain tasks.

- Protocol participation: Users and contributors utilize $THQ to access features, participate in coordination workflows, and interact with the ecosystem.

- Incentive alignment: The token rewards agents and contributors for productive behavior, helping maintain network efficiency and reliability.

- Governance involvement: $THQ holders can participate in governance processes that influence protocol upgrades and ecosystem parameters.

These use cases position Theoriq as enabling infrastructure-level functionality, rather than a single application or vertical.

What’s Next for Theoriq (THQ)?

Looking ahead, Theoriq’s roadmap is expected to focus on expanding agent coordination capabilities, growing ecosystem integrations, and increasing decentralization. As AI agents become more prevalent across DeFi and Web3, Theoriq aims to serve as a foundational layer that supports increasingly complex workflows and cross-protocol interactions. Continued development, community participation, and broader adoption will play a key role in shaping the long-term utility and relevance of Theoriq (THQ).

Theoriq (THQ) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for Theoriq (THQ) outlines a structured path toward expanding its role as a core coordination layer for AI agents in Web3, with an emphasis on protocol robustness, ecosystem growth, and progressive decentralization.

| Quarter | Roadmap |

| Q3 2025 | Expansion of AI agent coordination features, improved smart contract tooling, and early ecosystem integrations |

| Q4 2025 | Broader ecosystem onboarding, enhanced incentive mechanisms for agents and contributors, and governance framework refinements |

| Q1 2026 | Scaling coordination workflows, deeper cross-protocol compatibility, and increased community participation in governance |

| Q2 2026 | Continued decentralization, ecosystem maturity, and support for more complex multi-agent use cases |

These roadmap milestones highlight the practical value of $THQ in the AI agent coordination and Web3 infrastructure space, reinforcing Theoriq’s long-term positioning as foundational middleware for decentralized, intelligent systems.

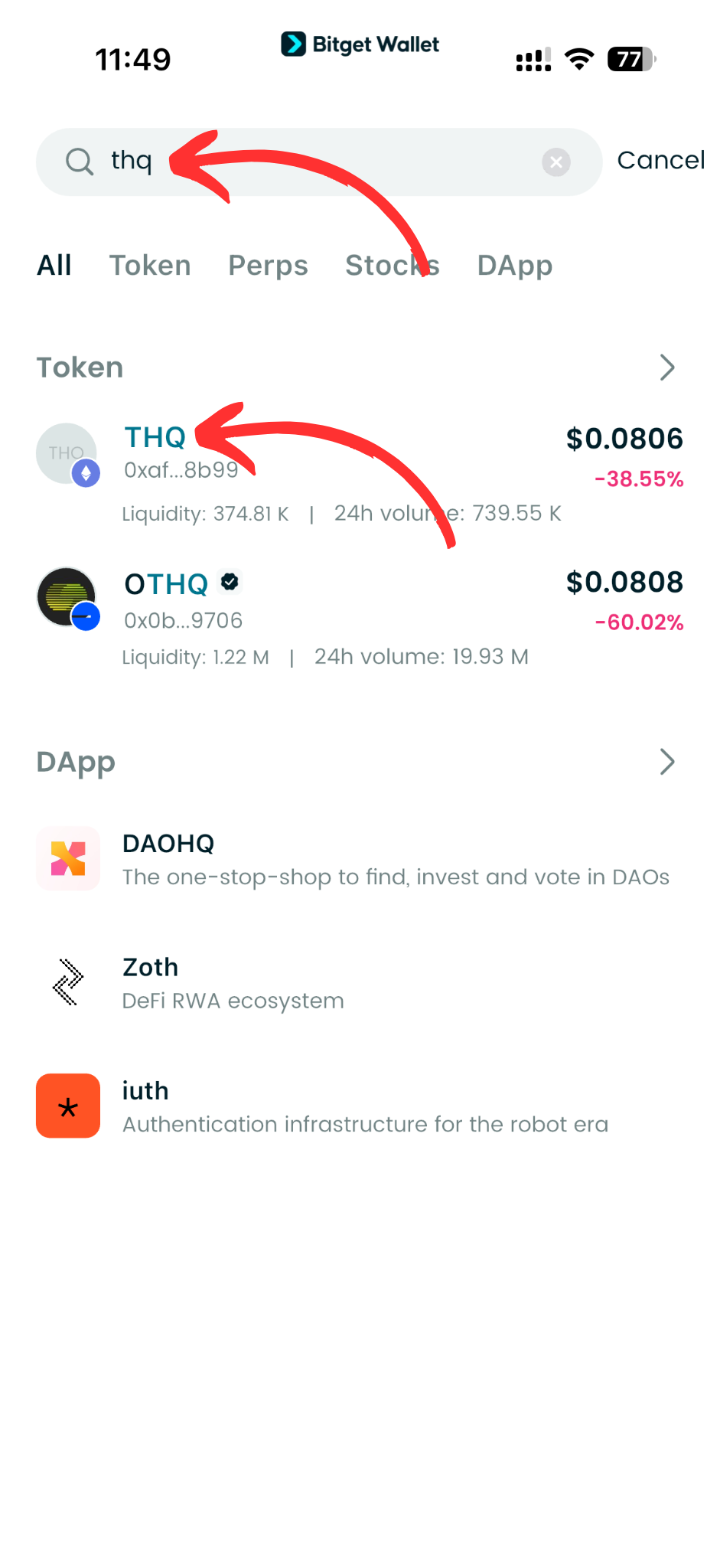

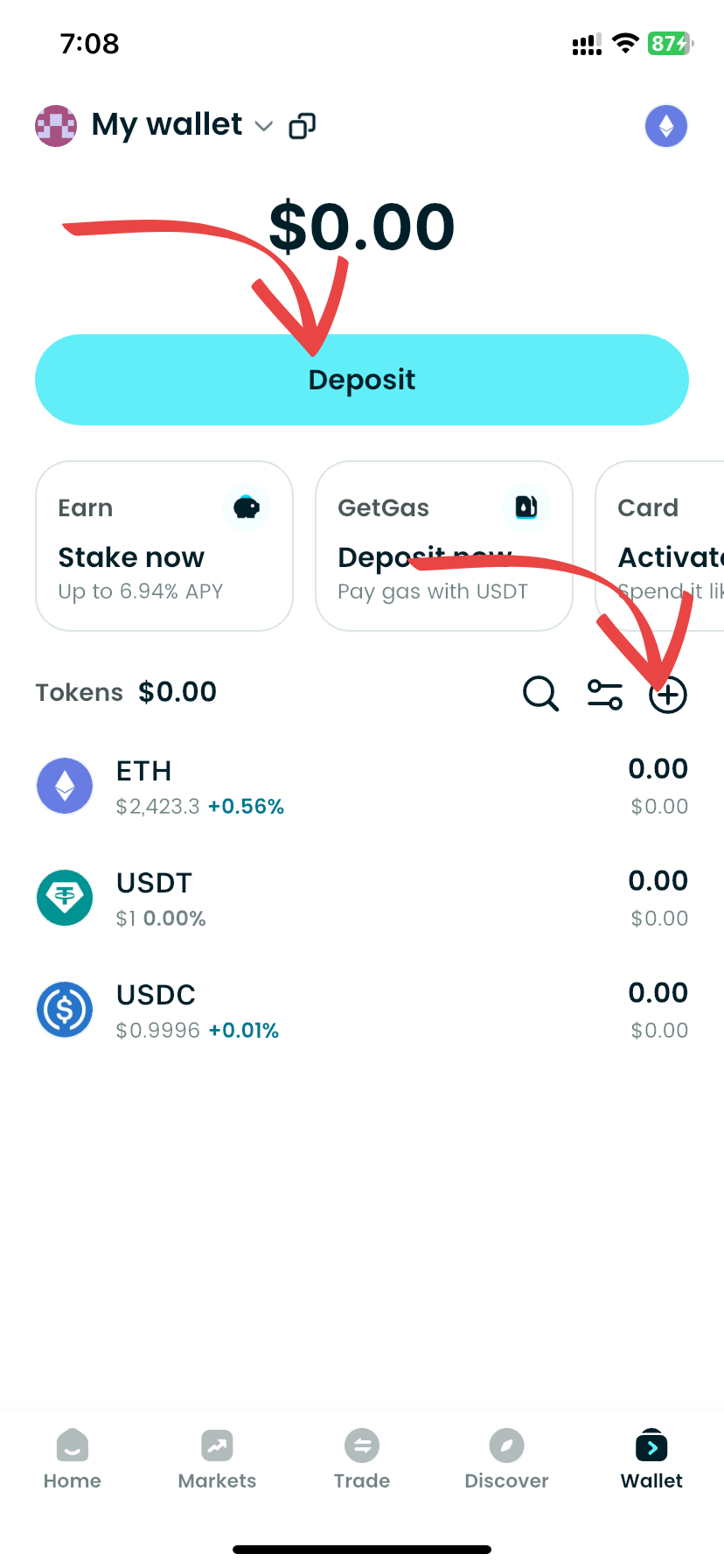

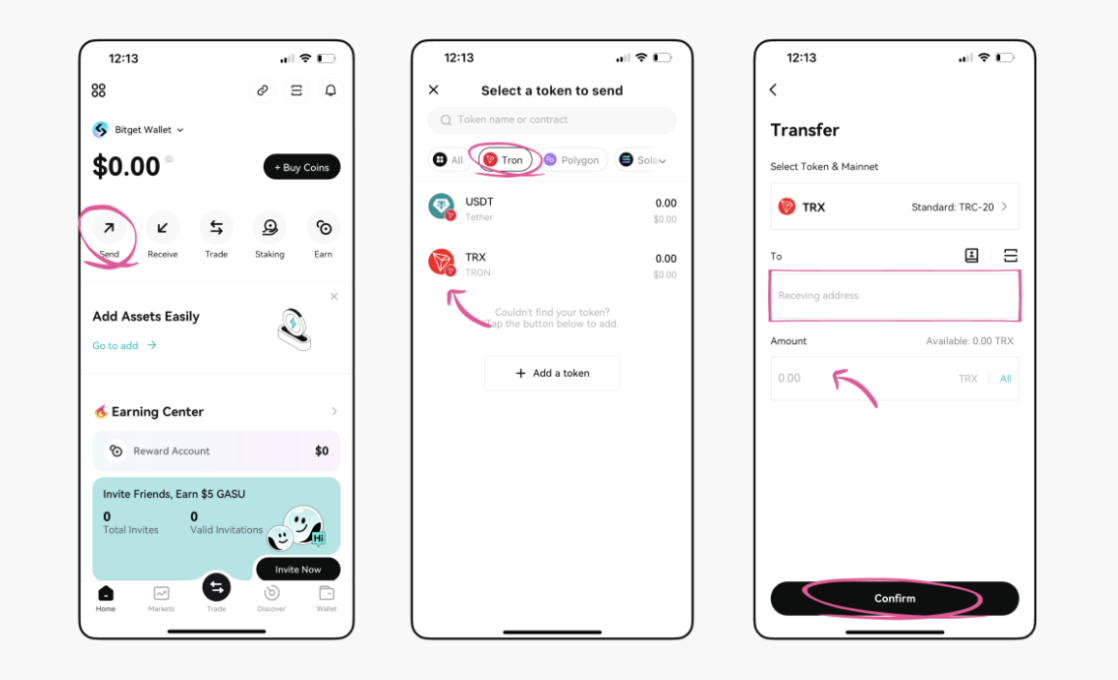

How to Buy Theoriq (THQ) on Bitget Wallet?

Trading Theoriq (THQ) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Theoriq (THQ).

Step 3: Find Theoriq (THQ)

On the Bitget Wallet platform, go to the market area. Search for Theoriq (THQ) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

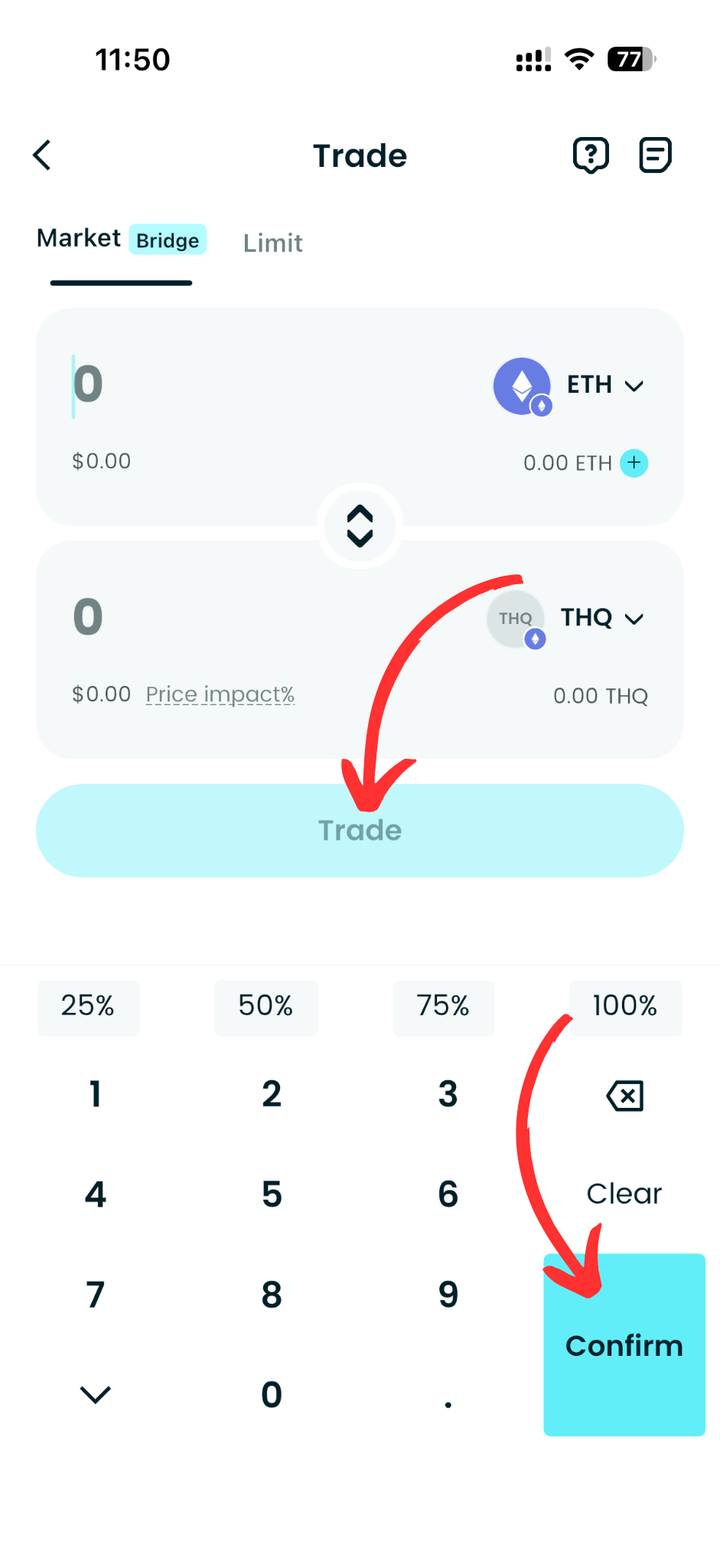

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, THQ/USDT.

By doing this, you will be able to exchange Theoriq (THQ) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Theoriq (THQ) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Theoriq (THQ).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Theoriq (THQ) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

▶Learn more about Theoriq (THQ):

Conclusion

The Theoriq (THQ) listing on Coinbase isn’t just about short-term gains—it signals a meaningful step toward building a stronger, decentralized future for AI-driven Web3 infrastructure. With a mission focused on on-chain coordination, secure execution, and incentive alignment for AI agents, Theoriq is positioning itself as a foundational layer in the evolving Web3 and AI ecosystem.

As momentum builds, getting involved early—whether through trading, participating in governance, or engaging with the community—can help users stay ahead as AI-powered coordination becomes more integral to decentralized applications.

For secure and effortless asset management, Bitget Wallet offers the perfect solution. With self-custody security, cross-chain support, and a beginner-friendly interface, it ensures you can trade and store digital assets with confidence.

👉 Step into the future of Web3—download Bitget Wallet today and unlock new opportunities in decentralized finance and AI-powered ecosystems.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Theoriq (THQ)?

Theoriq (THQ) is a decentralized AI agent coordination protocol designed to enable intelligent agents to collaborate, execute tasks, and align incentives on-chain. It serves as infrastructure for AI-driven applications across Web3 rather than a single end-user product.

2. What is the $THQ token used for?

The $THQ token is used for protocol participation, incentive alignment, and governance within the Theoriq ecosystem. It helps coordinate agent activity, rewards contributors, and allows token holders to take part in decisions related to protocol upgrades and ecosystem parameters.

3. Where can I trade Theoriq (THQ)?

Theoriq (THQ) is available on select centralized exchanges, and Coinbase has announced plans to support THQ, with spot trading expected to open once liquidity conditions are met. Users should always check official exchange announcements, including Coinbase updates, for the most accurate and current trading status.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.