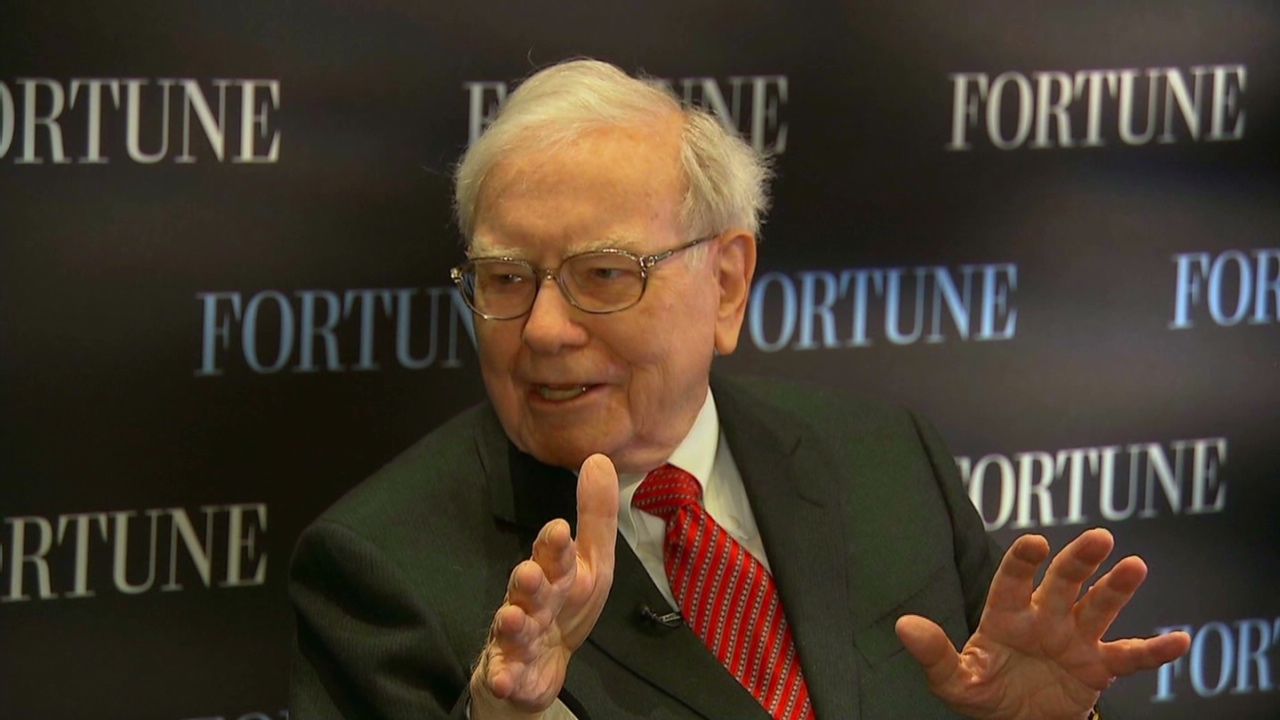

Warren Buffett’s Rules for Crypto Investors You Shouldn’t Ignore Today

Warren Buffett’s Rules for Crypto Investors offer a rare blueprint for navigating the fast-moving world of Bitcoin, AI, and Web3 without losing discipline. While Buffett has famously criticized Bitcoin as non-productive, he has also quietly shaped the strategies investors use to evaluate risk, value, and long-term trends. His principles — sharpened over 60 years of outperformance — remain extremely relevant to crypto users seeking clarity amid hype and volatility.

Today’s markets move faster than ever. AI startups surge overnight, crypto memecoins explode in hours, and hype often overshadows fundamentals. Buffett’s approach is a powerful reminder that technology changes but sound judgment does not.

In this article, we’ll explore Buffett’s most important rules, how they apply to crypto, and how investors can act on them safely.

Key Takeaways

- Buffett’s core rules, understanding what you invest in, avoiding hype, and focusing on value — are more relevant than ever in crypto.

- Buffett’s long-term investing philosophy shows that success in AI, Bitcoin, and crypto requires patience, research, and choosing assets that produce real utility or cash flow.

- Applying Buffett’s philosophy helps crypto investors avoid trend-driven losses and build sustainable, well-managed portfolios.

Why Does Warren Buffett’s Rules for Crypto Investors Emphasize “Invest Only in What You Understand”?

Buffett’s long-standing principle — never invest in something you cannot explain — is a crucial first filter for crypto investors. This rule protects investors from buying assets based on hype, social media trends, or fear of missing out.

How Does This Rule Apply to Crypto and AI?

Buffett openly admits he doesn’t fully understand AI despite its transformative power. This humility stands in contrast to tech leaders who pretend to be experts. In crypto, misunderstanding is even more dangerous — many investors buy tokens they cannot define or explain, from tokenomics to utility to risks.

Crypto investors should ask themselves simple Buffett-style questions:

- Can I explain what this token actually does?

- Do I understand its revenue model or purpose?

- Do I know who built it and why?

Source: Edition.cnn.com

What Can Crypto Investors Learn From Buffett’s Caution?

Buffett’s caution reminds investors that buying into something you don’t understand is the fastest path to costly mistakes. In crypto, this often leads people to fall for:

- Memecoin pumps with no real utility

- Anonymous developer projects lacking accountability

- AI-branded tokens using “AI” only for marketing

- Influencer-driven hype cycles that collapse as quickly as they rise

The alternative is clear: build understanding before committing capital. This means learning blockchain basics, reading project documentation, and relying on trustworthy educational resources such as Bitget Academy — all of which help reduce emotional decision-making and align with Buffett’s philosophy of informed, disciplined investing.

Why Does Buffett Prioritize Value Over Hype in Bitcoin and Crypto?

Buffett’s famous line — “Price is what you pay. Value is what you get.” — captures the heart of his skepticism toward Bitcoin and speculative crypto assets. He argues that assets should produce output, cash flow, or utility.

How Does Buffett’s Value Lens Apply to Bitcoin?

Buffett once said that even if he owned all the Bitcoin in the world, he wouldn’t keep it because “it doesn’t produce anything.” Despite this, Berkshire Hathaway has indirect exposure to Bitcoin through:

- Nu Holdings (NuBank), which launched Nucripto and Nucoin

- Jefferies Financial Group, which holds shares in the iShares Bitcoin Trust (IBIT)

This reflects an important nuance: Buffett rejects speculation but respects business models where digital assets are part of broader financial ecosystems.

What Does Buffett Consider Real Innovation in Tech and AI?

Buffett praises innovation that creates value, not hype. Alphabet (GOOGL) — which Berkshire invested $4 billion into — is a prime example:

| Area | Why Buffett Values It |

| Google Search | Strong margins, real customer demand |

| Gemini AI Chatbot | 650M MAUs, solves real user problems |

| YouTube | >$10B quarterly ad revenue |

| Google Cloud | 34% YoY growth, structural demand from AI startups |

Unlike hype-driven tokens, Alphabet demonstrates consistent value creation — a key Buffett criterion.

What Can Crypto Investors Learn From Buffett’s “Compounding Beats Chasing” Philosophy?

Buffett’s compounding philosophy is one of his greatest lessons. Instead of chasing fast gains, he allows time and discipline to grow wealth. Crypto markets — with rapid price swings and trend-driven surges — test this rule constantly.

How Can Crypto Investors Apply Compounding to Their Strategy?

Buffett-style compounding in crypto includes:

- Dollar-cost averaging (DCA) into strong assets

- Holding high-utility tokens with long-term adoption

- Earning stable yield through on-chain products

- Avoiding unnecessary trading that erodes returns

To apply these habits consistently, investors need tools that keep long-term portfolio management simple, secure, and reliable across multiple chains — and Bitget Wallet happens to bring these elements together in one place.

CTA Button: Trade, store, and explore Web3 seamlessly — beginner-friendly with Bitget Wallet.

Why Do Fast-Moving Markets Tempt Investors to Ignore This Rule?

AI startups rise and fall in weeks. Memecoins often surge 1000% in days, driven by FOMO. Yet long-term data shows only a small fraction of speculative tokens survive multiple cycles. Buffett’s steady approach — proven across six decades — helps investors avoid emotional mistakes triggered by volatility.

Source: Edition.cnn.com

How Can Crypto Users Apply “Choose the Right Heroes” From Warren Buffett’s Rules for Crypto Investors?

Buffett often credits his success to choosing the right mentors — people with integrity, clarity, and proven judgment. In crypto, where narratives can shift overnight and influencer-driven promotion is rampant, this rule is more important than ever. Investors must distinguish between trustworthy builders and hype-driven personalities.

Who Are the “Right Heroes” Crypto Investors Should Follow?

Crypto investors should prioritize:

- Builders and founders who’ve shipped credible products and maintain transparent communication.

- Teams with clear long-term roadmaps, consistent updates, and audited smart contracts.

- Researchers and developers contributing to blockchain fundamentals, not just marketing.

- Projects with active GitHub repos, governance forums, and real user adoption.

Examples of credible leaders include:

- Chainlink (LINK) researchers who publish proof-of-reserve standards

- Ethereum (ETH) core developers who maintain consensus upgrades

- Cosmos (ATOM) teams who innovate cross-chain interoperability

These align with Buffett’s advice: admire people for their competence and character, not their popularity.

How Can Investors Identify and Avoid the Wrong Heroes in Crypto?

To avoid misleading figures:

- Reject influencers pushing “10x overnight” claims.

- Avoid anonymous teams with no accountability.

- Stay away from tokens promoted solely through social media hype.

- Conduct diligence using:

- GitHub activity

- Audit reports

- Team backgrounds

- Roadmap delivery consistency

This mirrors Buffett’s lifelong principle: avoid people who emphasize excitement over substance.

Why Does Buffett Warn Against Assets That ‘Don’t Produce’?

One of Buffett’s sharpest critiques is aimed at assets that generate no output. Bitcoin, in his view, produces nothing — no cash flow, no dividends, no services. In crypto, however, many assets do generate real value through staking, fees, and protocol revenue.

This section helps investors distinguish speculative tokens from productive ones.

Which Crypto Assets Actually Produce Cash Flow or Utility?

Examples of productive crypto assets include:

- Staking protocols like Lido Finance (LDO) or Ethereum (ETH) staking yield

- RWA platforms such as Ondo Finance (ONDO) offering tokenized treasury yields

- DeFi lending tokens like Aave (AAVE) that generate revenue from borrowing

- Tokenized equities (U.S. stock tokens) that represent fractional access to real-world assets

- MakerDAO (MKR/DAI) which earns revenues from real-world credit markets

These align more closely with Buffett’s principle: value must come from what the asset produces, not from market excitement.

Read more: What Are Real-World Assets (RWAs): A Complete Guide To Asset Tokenization

How Should Investors Evaluate Whether a Token “Produces Value”?

Use a practical Buffett-style checklist:

| Evaluation Criteria | What to Look For |

| Utility | Does the token enable access, governance, security, or functionality? |

| Revenue | Does the protocol generate fees or yield? |

| Adoption | Are real users and developers active on the platform? |

| Sustainability | Is growth based on fundamentals or short-term incentives? |

| Transparency | Are audits, reserves, or financials published? |

This framework filters hype-based tokens from fundamentally sound ones.

How Does Buffett Balance Embracing Change While Staying Grounded?

Buffett has repeatedly stated that AI is “a genie out of the bottle,” powerful enough to reshape industries — but also dangerous without ethics. This philosophy applies directly to crypto: innovation should be embraced, but not blindly followed.

What Does Buffett’s View of AI Teach Crypto Investors About Real Innovation?

Just like AI, crypto innovation must solve actual problems:

- AI is valuable when improving search, automation, or infrastructure (e.g., Alphabet’s Gemini, Google Cloud).

- Blockchain is valuable when enabling decentralized security, cross-chain computation, or transparent financial rails.

Buffett’s AI perspective helps investors identify crypto projects with meaningful innovations such as:

- Faster blockchains with practical use cases (Solana (SOL))

- Interoperability frameworks (Cosmos (ATOM), LayerZero (ZRO))

- AI-integrated protocols (Fetch.AI (FET), Bittensor (TAO))

Not all innovation is equal — real value comes from solving real problems.

How Can Investors Stay Grounded Instead of Chasing Trends in Crypto?

Practical ways to stay grounded:

- Favor tokens with long-term user adoption, not sudden social media hype.

- Study project fundamentals before investing in meme-driven volatility.

- Observe how Buffett invested in Alphabet: he waited until AI fundamentals showed clear value before moving $4 billion.

- Avoid FOMO-driven decisions and focus on consistency, not virality.

This mindset helps investors remain stable even during chaotic market cycles.

Source: Edition.cnn.com

How Can Crypto Investors Use Buffett’s Rule: “Learn, Adapt, Move Forward”?

Buffett’s philosophy of learning from mistakes — without dwelling on them — is particularly important in crypto, where volatility is high and missteps can be costly.

How Should Crypto Investors Respond to Losses and Market Downturns?

Buffett-style responses include:

- Review decisions objectively, identifying what went right or wrong.

- Avoid panic-selling during market fear cycles.

- Prioritize long-term fundamentals instead of short-term emotional reactions.

- Do not take riskier trades to recover losses quickly — this accelerates damage.

This rule encourages resilience and continuous improvement.

What Practical Methods Help Investors Learn and Improve Over Time?

Crypto investors can strengthen their strategy through:

- On-chain explorers (Etherscan, Solscan) to study transaction patterns

- Portfolio trackers inside Bitget Wallet for monitoring asset performance

- DeFi dashboard analytics to understand yield, risk, and liquidity

- Regularly updating strategies based on market lessons

Learning is continuous — just as Berkshire improves through decades of iteration.

What Is the Long-Term Investment Mindset in Crypto According to Warren Buffett’s Principles?

Buffett’s long-term mindset emphasizes durability, consistent development, and real economic value. In crypto, this means focusing on ecosystems that demonstrate real usage and sustainable growth.

Below is a structured breakdown following Buffett’s principles.

1. Layer-1 Blockchains With Proven Utility

These networks show high user activity, developer traction, and robust ecosystems:

- Ethereum (ETH) — leading smart-contract platform with deep DeFi usage and high security

- Solana (SOL) — fast L1 powering consumer apps, DeFi, and memecoin ecosystems

- Avalanche (AVAX) — subnet architecture for enterprises and scaling

- NEAR Protocol (NEAR) — user-friendly developer environment and strong scaling

Why Buffett Would Approve: they solve real problems, attract real users, and sustain long-term demand.

2. Cross-Chain Infrastructure & Interoperability Networks

Interoperability solves one of blockchain’s biggest challenges: fragmented ecosystems.

Key examples:

- Cosmos (ATOM) — IBC connecting dozens of sovereign chains

- Polkadot (DOT) — shared security and modular parachains

- LayerZero (ZRO) — widely adopted cross-chain messaging protocol

These represent foundational Web3 infrastructure — similar to railroads and utilities in Buffett’s traditional framework.

3. AI + Blockchain Protocols With Long-Term Potential

Projects combining AI and blockchain in meaningful ways include:

- Fetch.AI (FET) — automation agents improving on-chain interactions

- SingularityNET (AGIX) — decentralized marketplace for AI models

- Ocean Protocol (OCEAN) — tokenized data for training AI

- Bittensor (TAO) — decentralized AI-training network with incentive layers

Buffett would point to real-world usage and structural demand, not buzzwords.

4. Transparent Teams With Consistent Delivery

Buffett emphasizes leadership quality. In crypto, transparency and consistent development are key:

- Arbitrum (ARB) — clear upgrades and stable governance

- Optimism (OP) — Superchain vision with public development roadmap

- Chainlink (LINK) — years of proven reliability and enterprise integration

These projects demonstrate “owner-operator” mentality — a Buffett favorite.

5. Real-World Asset (RWA) Protocols With Actual Revenue

RWAs mirror Buffett’s preference for productive assets:

- MakerDAO (MKR/DAI) — real-world treasury revenue

- Ondo Finance (ONDO) — tokenized U.S. bond products

- Centrifuge (CFG) — credit market infrastructure leveraging stable yields

These are closest to Buffett’s value-investing mindset.

Read more: On-chain RWA Market 2025: Growth, Risks, and Investment Opportunities

6. Crypto Projects Aligned With Multi-Year Macro Trends

Long-term resilience matters more than hype cycles:

- Bitcoin (BTC) — digital store of value with global adoption

- Lido Finance (LDO) — leading staking infrastructure for Ethereum

- Aave (AAVE) — established DeFi lending protocol with multi-year usage

These assets are durable across cycles, reflecting Buffett’s focus on longevity.

Why Do Warren Buffett’s Rules for Crypto Investors Emphasize Respect and Ethics in Web3?

Buffett’s famous maxim — “The cleaning lady is as much a human being as the Chairman” — highlights his belief that integrity, respect, and fairness form the foundation of long-term success. In Web3, where anyone can build, trade, or launch tokens, ethical conduct is especially critical for investor protection and ecosystem trust.

Why Do Ethical Principles Matter in Permissionless Crypto Markets?

Open markets allow both innovation and exploitation. Ethical behavior protects investors from:

- Rug pulls and unverified smart contracts

- False promises from anonymous founders

- Manipulated token prices and insider-driven schemes

- Misleading APY claims and unsustainable tokenomics

Projects that practice transparency — publishing audits, maintaining open communication, and using clear documentation — tend to survive longer and earn community trust. This reflects Buffett’s principle: businesses built on honesty outperform those built on hype.

How Can Crypto Investors Apply Ethics to Protect Themselves?

Practical ways to follow Buffett-style ethical filters:

- Avoid platforms offering unrealistic APYs.

- Select protocols that publish audits, proof-of-reserves, or on-chain reporting.

- Prefer well-known, transparent developer teams.

- Validate claims by reading documentation, not influencer posts.

Ethics reduce risk — and align with long-term value creation.

How Can Crypto Investors Follow Buffett’s Rules and Stay Safe Using Bitget Wallet?

Buffett’s rules are built on three timeless pillars — protect your capital, understand your decisions, and stay disciplined no matter how loud the market gets. In the chaotic world of crypto, where hype cycles move at lightning speed, these principles matter more than ever.

That’s where Bitget Wallet becomes a powerful ally: it gives investors a way to participate in Web3 without sacrificing safety, clarity, or long-term discipline.

What Tools in Bitget Wallet Help Investors Build Buffett-Style Safety and Discipline?

Bitget Wallet brings together exactly the kind of safeguards and long-term structures that Buffett would appreciate — tools that help investors grow steadily instead of gambling on luck:

- Non-custodial protection: Full ownership of your crypto, aligning perfectly with Buffett’s belief in controlling your own risks.

- MPC login: Removes seed-phrase stress while keeping your self-custody intact, reducing common user errors.

- 130+ chain support: Allows safe diversification across ecosystems without managing multiple fragmented wallets.

- Stablecoin Earn Plus (up to 10% APY): A predictable, compounding-friendly yield option that echoes Buffett’s slow-and-steady principle of wealth accumulation.

Together, these features form a disciplined environment where investors can make thoughtful decisions instead of reacting emotionally to market noise.

How Does Bitget Wallet Help Investors Avoid Hype and Make Smarter Decisions?

Buffett often warns against letting emotions dictate investment choices — especially during moments of excitement or fear. Bitget Wallet helps put this wisdom into practice by giving investors tools that cut through noise and hype:

- Clear portfolio tracking to spot unhealthy overexposure before it becomes a problem

- Cross-chain swaps that let you rebalance safely — without risky bridge detours

- Built-in token insights and indexing so you can evaluate assets with data, not FOMO

- Early access to trending tokens, giving strategic opportunities without chasing pumps blindly

With a setup like this, investors can follow Buffett’s rules naturally: think slowly, act intentionally, and grow with discipline.

Conclusion

Warren Buffett’s Rules for Crypto Investors remind us that even in a world shaped by AI breakthroughs, memecoin surges, and unpredictable market cycles, the fundamentals never change. The investors who thrive long-term are those who truly understand what they own, focus on real value instead of noise, stay calm when others panic, and keep learning with every market shift. These timeless principles carried Buffett through six decades of market storms — and they’re just as essential for anyone navigating today’s Web3 landscape.

But discipline is more than mindset; it’s also about choosing the right tools. Bitget Wallet gives crypto investors a practical way to apply Buffett’s philosophy: secure stablecoin storage, seamless cross-chain swaps, early access to new tokens, and data-driven insights to reduce emotional decision-making. It’s a modern, Web3-native environment where long-term thinking can genuinely thrive.

So don’t hesitate, download Bitget Wallet today and invest the way Buffett would approve: safer, clearer, and with the confidence to stay ahead in every market cycle!

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What are the most important parts of Warren Buffett’s Rules for Crypto Investors?

Buffett’s most important rules include investing only in what you understand, focusing on real value instead of hype, avoiding assets that do not produce utility, and maintaining long-term discipline.

2. Does Warren Buffett invest directly in Bitcoin or crypto?

Buffett does not invest in Bitcoin personally. However, Berkshire Hathaway has indirect exposure through investments in Nu Holdings (Nucripto, Nucoin) and Jefferies (shares in the iShares Bitcoin Trust ETF).

3. How can users store crypto safely following Buffett-style discipline?

Bitget Wallet helps users store crypto safely through non-custodial security, stablecoin management, and cross-chain tools. Combined with Buffett-style discipline—avoiding hype, diversifying, and focusing on long-term value—it creates a safer way to manage assets.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.