What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

What is a prediction market and why are crypto users increasingly relying on blockchain-based prediction markets to forecast real-world events?

At its core, a prediction market is a system that allows participants to trade on the outcomes of future events. Instead of polls or expert opinions, these markets use real money incentives to aggregate information and express probabilities through prices. In recent years, crypto and prediction markets have converged, enabling on-chain settlement, transparent resolution, and global participation.

In this article, we’ll break down how prediction markets work, real-world examples, key risks, legal considerations, and how users participate in blockchain-based prediction markets using tools like Bitget Wallet.

Key Takeaways

-

What is a prediction market:

A prediction market lets participants trade on future outcomes, with prices reflecting the probability of those events.

-

How prediction markets work:

Prediction markets work by trading outcome-based contracts that resolve and pay out once the real-world event is confirmed.

-

Why blockchain-based prediction markets matter:

Blockchain-based prediction markets automate settlement with smart contracts, improving transparency and trust without intermediaries.

What Is a Prediction Market?

What is a prediction market is best understood as a system where participants trade on future outcomes, with prices reflecting collective probability. Prediction markets use financial incentives to aggregate crowd wisdom and forecast real-world events more accurately than traditional methods.

How a prediction market turns opinions into probabilities?

A prediction market allows users to buy or sell positions on whether a specific event will happen. This process is often called event outcome trading. As more participants trade, prices adjust based on supply and demand.

Because participants risk capital, prediction markets harness crowd wisdom rather than casual opinions. If new information emerges, prices shift quickly—turning fragmented beliefs into a single probability signal. This mechanism explains why prediction markets are often used for forecasting elections, economic indicators, and policy outcomes.

What Types of Prediction Market Platforms Exist Today?

Prediction market platforms generally fall into two categories: centralized and decentralized. These models differ in how assets are held, how transparent market activity is, and how users access and interact with event outcome trading.

Centralized vs decentralized prediction market platforms

| Feature | Centralized Platforms | Decentralized Platforms |

| Asset custody | Platform-controlled | User-controlled |

| Transparency | Limited | On-chain |

| Settlement | Manual / internal | Smart contracts |

| Access | Permissioned | Permissionless |

Centralized platforms resemble traditional financial markets, while decentralized prediction market platforms rely on blockchain infrastructure and smart contracts to reduce trust assumptions.

How users typically access prediction markets

Most users access prediction markets by connecting a wallet and interacting directly with markets tied to specific event outcomes. In blockchain-based prediction markets, participation typically involves:

- Connecting a Web3 wallet like Bitget Wallet to the prediction market platform

- Depositing funds, often stablecoins, to trade event outcome contracts

- Interacting with smart contracts that represent Yes / No outcomes

- Paying network fees (gas) for on-chain transactions

- Relying on on-chain settlement rather than centralized intermediaries

How Do Prediction Markets Work?

How prediction markets work can be understood as a step-by-step process that begins with market creation and binary contracts, followed by price discovery, outcome resolution, and final payouts. These core mechanics apply across both traditional and blockchain-based prediction markets, with on-chain automation improving transparency, efficiency, and trust.

Step 1 — Market creation and event definition

A prediction market begins when a platform defines a specific future event that can be objectively verified, such as an election result, policy decision, or economic outcome. The event must be framed clearly to avoid ambiguity at settlement.

Possible outcomes are usually binary (Yes/No), though some markets may include multiple outcomes. At this stage, the platform also sets key parameters such as the market’s expiration date, the data source used for resolution, and the conditions under which the market will be settled.

Step 2 — Trading binary contracts

Once the market is live, participants trade binary contracts that represent each possible outcome. Each contract pays out a fixed amount if the selected outcome occurs and nothing if it does not.

The contract price reflects the market’s collective expectation. For example, a price of $0.65 implies the market assigns a 65% probability to that outcome. Unlike traditional derivatives, binary contracts focus on a single, clearly defined event rather than price exposure or leverage.

Step 3 — Price discovery through market activity

As new information becomes available—such as news reports, data releases, or changing sentiment—traders adjust their positions. This buying and selling activity causes prices to move, continuously updating the market’s probability estimate.

Liquidity plays a crucial role at this stage. Markets with higher participation tend to produce more stable and accurate price signals, while low-liquidity markets may experience sharp swings. This price discovery process is central to how prediction markets work as forecasting tools.

Step 4 — Outcome resolution and oracle verification

When the event reaches its conclusion, trading is halted and the market enters the resolution phase. The outcome must be verified based on predefined criteria to ensure fairness and consistency.

In blockchain-based prediction markets, this verification is handled through oracles, which supply real-world data to the blockchain. Oracles ensure that the final result is recorded on-chain in a transparent and tamper-resistant manner, enabling trustless settlement.

Step 5 — Payout settlement and distribution

After the outcome is confirmed, winning contracts settle at their full value, while losing positions expire worthless. This final settlement converts probability-based prices into realized gains or losses.

In decentralized systems, smart contracts automatically distribute payouts to eligible participants. This automation reduces delays, removes intermediaries, and minimizes counterparty risk, completing the prediction market lifecycle in a transparent and efficient way.

How Do Blockchain-Based Prediction Markets Work in Crypto?

Blockchain-based prediction markets use smart contracts and decentralized infrastructure to manage market creation, trading, resolution, and payouts without relying on a central authority. By operating on-chain, these markets improve transparency, automate settlement, and allow participants to independently verify outcomes and transactions.

Why blockchain improves prediction markets?

Blockchain improves prediction markets by replacing centralized control with code-based enforcement. Core market functions are handled automatically through smart contracts, reducing reliance on intermediaries.

Key advantages include:

- Rule enforcement by smart contracts: trading conditions and settlement logic are executed automatically

- Decentralized settlement: payouts occur without manual intervention

- Public transaction records: all trades and outcomes are verifiable on-chain

- Reduced counterparty risk: users do not need to trust a central operator

Together, these features make blockchain-based prediction markets more transparent and resilient than traditional platforms.

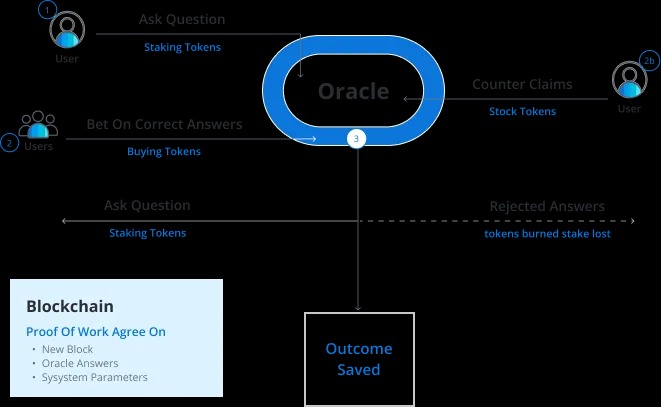

The role of oracles in crypto prediction markets

Smart contracts cannot access real-world data directly, which makes oracles a critical component of crypto prediction markets. Oracles act as data bridges, supplying verified external information to the blockchain when an event concludes.

In practice, oracles are responsible for:

- Fetching real-world outcomes from predefined data sources

- Submitting verified results on-chain for market resolution

- Triggering smart-contract settlement logic

- Ensuring fair and consistent payouts based on confirmed outcomes

Accurate oracle input is essential for maintaining trust, as incorrect data can lead to improper resolution and settlement.

Source: Antier Solutions

What Are Prediction Markets Used For in the Real World?

What are prediction markets used for goes beyond speculation. Prediction markets are widely applied as forecasting tools across politics, finance, and entertainment, where prices aggregate information into probability signals. When combined with crypto infrastructure, these markets gain broader access, faster settlement, and continuous global participation.

Real-world prediction market use cases across major industries

Prediction markets are commonly used to forecast outcomes in areas where information is fragmented or uncertain, helping surface collective expectations more efficiently than polls or expert opinion alone.

Key use cases include:

- Politics and elections: estimating vote outcomes, policy decisions, and geopolitical events

- Financial indicators: anticipating interest-rate changes, earnings results, and macroeconomic trends

- Sports and entertainment: predicting game results, tournament winners, and award outcomes

These prediction markets real-world examples are often valued for information discovery and signal extraction rather than pure speculation.

Structural advantages of crypto-powered prediction markets

Crypto infrastructure enhances prediction markets by removing geographic and institutional barriers that limit traditional platforms.

Core advantages include:

- Global participation: open access for users across regions

- Permissionless design: no central gatekeepers for market entry

- Faster settlement: on-chain resolution without manual processing

- Continuous operation: markets can run and settle at any time

By combining crypto and prediction markets, forecasting becomes more inclusive, transparent, and efficient across borders.

Prediction Markets vs Gambling — What’s the Real Difference?

The comparison between prediction markets vs gambling centers on purpose and structure. Prediction markets are designed to aggregate information and produce probability signals, while gambling focuses on entertainment and chance. This distinction explains why prediction markets are often treated as information tools rather than traditional games of luck.

Are prediction markets gambling or financial instruments?

Prediction markets are generally built around skill-based forecasting rather than pure randomness. Participants are incentivized to analyze data, news, and trends before committing capital, and market prices adjust as new information becomes available.

By contrast, gambling outcomes are typically driven by chance, with odds set by a central operator that maintains a built-in advantage. In prediction markets, probabilities are formed organically through trading activity, and there is no “house” controlling the odds.

Key differences include:

- Skill-based forecasting vs random outcomes

- Market-driven incentives vs house-controlled odds

- Probability discovery vs entertainment-focused wagering

Why do regulators see prediction markets differently?

Regulators often view prediction markets through the lens of information discovery rather than entertainment. Because these markets can reveal collective expectations about future events, they are sometimes evaluated as analytical or financial tools.

That said, regulatory treatment varies by jurisdiction. Policy frameworks may consider factors such as market structure, types of events offered, and participant protections. This variation explains why prediction markets occupy a distinct and sometimes uncertain regulatory category compared to conventional gambling.

Regulatory comparison: Prediction markets vs gambling

| Aspect | Prediction Markets | Gambling |

| Primary purpose | Information discovery and forecasting | Entertainment and chance |

| Outcome drivers | Data, analysis, collective belief | Randomness or fixed odds |

| Pricing mechanism | Market-driven probability signals | House-set odds |

| Participant role | Active forecasting and trading | Passive wagering |

| Regulatory treatment | Often evaluated as financial or analytical tools | Regulated as gaming activities |

What Are the Biggest Risks of Prediction Markets

Prediction market risks stem from structural, technical, and regulatory factors. While prediction markets can be effective forecasting tools, they are not immune to price distortion, data reliability issues, or legal uncertainty. Understanding these risks helps participants evaluate signals more carefully and avoid misinterpreting market outcomes.

Market manipulation and liquidity risks

Prediction markets rely on active participation to produce accurate probability signals. When liquidity is low, prices can be influenced disproportionately by a small number of traders, reducing reliability.

Common liquidity-related risks include:

- Price distortion: large trades can temporarily skew probabilities

- Thin markets: limited participation leads to volatile pricing

- Reduced signal quality: prices may reflect positioning rather than information

These issues are more common in niche or newly launched markets with fewer participants.

Legal and regulatory uncertainty

The legal status of prediction markets varies significantly across jurisdictions. Some regions permit certain types of markets, while others impose restrictions or classify them differently under existing laws.

Key regulatory risks include:

- Jurisdictional differences: legality depends on local frameworks

- Event-type restrictions: political or financial markets may face tighter rules

- Unclear classification: questions around are prediction markets legal remain unresolved in many regions

Because regulation can change over time, legal uncertainty remains one of the most significant risks facing prediction market participants and platforms.

How Can Users Access Blockchain-Based Prediction Markets with Bitget Wallet?

Accessing blockchain-based prediction markets requires a secure, non-custodial interface for interacting with smart contracts and managing on-chain assets. Bitget Wallet serves as a Web3 gateway that allows users to connect to decentralized platforms, control their funds directly, and explore on-chain market signals without relying on centralized intermediaries.

Why Bitget Wallet is suitable for crypto prediction markets?

Bitget Wallet is designed for users who want direct, non-custodial access to Web3 applications, including decentralized prediction markets.

Key features that support prediction market participation include:

- Non-custodial control: users retain full ownership of their assets

- Cross-chain compatibility: access markets across multiple blockchain networks

- Secure smart-contract interaction: reduced reliance on centralized operators

- Beginner-friendly design: simplified navigation for on-chain participation

These features make Bitget Wallet a practical interface for engaging with crypto and prediction markets.

How can users spot early 1000X tokens with Bitget Wallet?

Beyond market access, Bitget Wallet also provides tools that help users observe early on-chain activity and emerging token trends.

Users can:

- Monitor Bitget Wallet’s Swap Ranking List to identify tokens with rapid changes in on-chain swap volume and liquidity

- Observe early cross-chain activity that may signal growing interest before centralized exchange listings

- Manage stablecoins directly in-wallet, allowing quicker response to on-chain momentum

- Explore trends through a beginner-friendly on-chain experience, without custodial risk

These signals are intended for trend observation and research, not guarantees of performance.

Track trending swaps, manage stablecoins, and explore early on-chain opportunities across chains with Bitget Wallet.

Read more: Best Crypto to Invest in 2026: Which Tokens Could Be the Next 1000x that Make You a Millionaire?

Conclusion

What is a prediction market ultimately comes down to one idea: using financial incentives to forecast future outcomes more accurately than opinions alone. By understanding how prediction markets work, users can better evaluate probabilities, risks, and signals.

Blockchain-based prediction markets enhance transparency and automation, but they still carry risks related to liquidity, regulation, and data accuracy. For users exploring these markets, tools like Bitget Wallet provide a secure, non-custodial way to interact with on-chain opportunities.

Trade, store, and explore Web3 prediction markets securely — beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is a prediction market and how does it work?

A prediction market allows participants to trade on future outcomes, with prices reflecting the collective probability of an event.

2. Are prediction markets legal in crypto?

Legality depends on jurisdiction. Some regions allow certain markets, while others impose restrictions.

3. What are the main risks of prediction markets?

Key risks include low liquidity, market manipulation, oracle failures, and regulatory uncertainty.

4. How are blockchain-based prediction markets different from traditional ones?

They use smart contracts and oracles to automate settlement and improve transparency without centralized control.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.