2025 PayFi Report: Insights into Crypto Payment Adoption

Announcements

Crypto payments are gaining momentum, but what truly drives users to adopt them? What obstacles hold them back? To answer these questions, we conducted an in-depth study of the Web3 PayFi landscape in our

PayFi Unlocked: Crypto Payment Adoption

Onchain Report. While adoption is on the rise, key challenges remain that must be addressed to make crypto payments a seamless and trusted financial tool.

Background

As digital assets continue integrating into mainstream finance, understanding the motivations and concerns of users is essential. Our research explores the key factors influencing adoption—whether it's the speed and cost-effectiveness of transactions or hesitations around security and usability. By analyzing user behavior across generations and regions, we uncover important trends shaping the future of crypto payments.

Emerging markets, for example, prioritize accessibility and lower costs, using crypto as a means to bypass traditional financial barriers. Meanwhile, users in developed markets are drawn to financial independence and privacy, preferring crypto as an alternative to centralized banking systems. These insights offer valuable guidance for industry players looking to refine payment experiences, build trust, and accelerate global adoption.

This report is based on an online survey conducted between February 7 and February 11, 2025, with 4,599 respondents from the Bitget Wallet community. Representing Gen Z, Millennials, and Gen X users across various global regions, the findings provide a comprehensive view of how crypto payments are evolving.

Key Takeaways

What Drives Crypto Payment Adoption?

Speed is the top driver of adoption, with 46% of respondents citing fast transactions as the primary reason for using crypto payments. Global accessibility follows closely, with 41% of users valuing crypto’s ability to facilitate seamless cross-border transactions, particularly in regions with limited banking infrastructure.

Cost savings also play a crucial role—37% of users prefer crypto due to lower transaction fees, while 31% appreciate the ability to avoid costly currency exchange rates. Additionally, 32% see crypto as a tool for financial independence, allowing them to transact without relying on banks.

Beyond these practical benefits, crypto is also seen as an investment. A third of respondents (33%) view their holdings as assets that may appreciate over time. Others value the privacy (37%) and control over personal funds (35%) that decentralized payments provide.

Regional differences further shape adoption patterns. In emerging markets, users prioritize speed, accessibility, and affordability. Africa (52%) and Southeast Asia (51%) lead in demand for faster transactions, while users in North America and Oceania (36%) emphasize the importance of smooth cross-border payments.

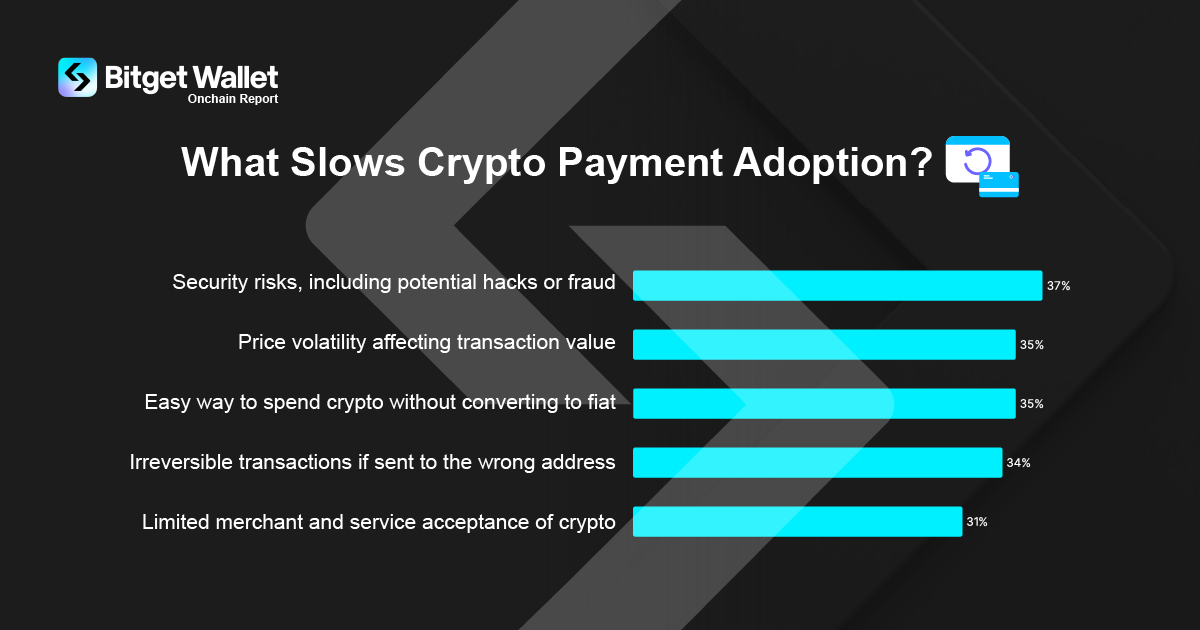

What’s Slowing Crypto Payment Adoption?

Despite growing interest, several barriers still hinder crypto payment adoption. Security concerns top the list, with 37% of users worried about hacks and fraud. The lack of legal protection (27%) and trusted payment providers (23%) further exacerbates these concerns, making users hesitant to transact with crypto.

Price volatility remains a significant challenge. About 35% of users find fluctuating token values problematic, making crypto payments unpredictable. Network congestion and high transaction fees during peak periods also deter users, limiting the cost-effectiveness of onchain payments.

Usability issues present additional obstacles. The risk of irreversible transactions (34%) makes mistakes costly, while limited merchant acceptance (31%) restricts real-world use. Additionally, 25% of respondents feel that crypto payments are too complex due to the technical nature of wallets and addresses. Simplifying the payment experience and expanding merchant adoption will be critical in overcoming these barriers.

The Future of PayFi with Bitget Wallet

At Bitget Wallet, we’re committed to addressing these challenges and making crypto payments more accessible, secure, and practical. As part of

Bitget Wallet's PayFi vision for 2025, we are introducing seamless onchain financial services that allow users to earn, send, and spend all within one integrated platform.

Imagine a financial ecosystem where you can stake stablecoins across multiple blockchains to earn passive yield while maintaining full control over your assets—while also using crypto for everyday purchases, from groceries to travel, without the hassle of volatility or complexity. By merging DeFi yield generation with real-world payments, we’re transforming crypto from a speculative asset into a practical financial tool, making digital finance accessible to billions worldwide.

As we continue to innovate, we invite you to be part of this journey toward a future where crypto payments are as seamless as traditional finance!

About Bitget Wallet

Bitget Wallet is the home of Web3, uniting endless possibilities in one non-custodial wallet. With over 60 million users, it offers comprehensive onchain services, including asset management, instant swaps, rewards, staking, trading tools, live market data, a DApp browser, an NFT marketplace, and crypto payment. Supporting over 100 blockchains, 20,000+ DApps, and 500,000+ tokens, Bitget Wallet enables seamless multi-chain trading across hundreds of DEXs and cross-chain bridges, along with a $300 million protection fund to ensure the safety of users' assets.

2025-03-24

2025-03-24Recommended

- AnnouncementBuilding Decentralized Finance in 2025: A Letter from Bitget Wallet CMO Jamie Elkaleh

2025-01-27