How to Create a Ethena(ENA) Wallet in Bitget Wallet

- 1. Create or import a wallet

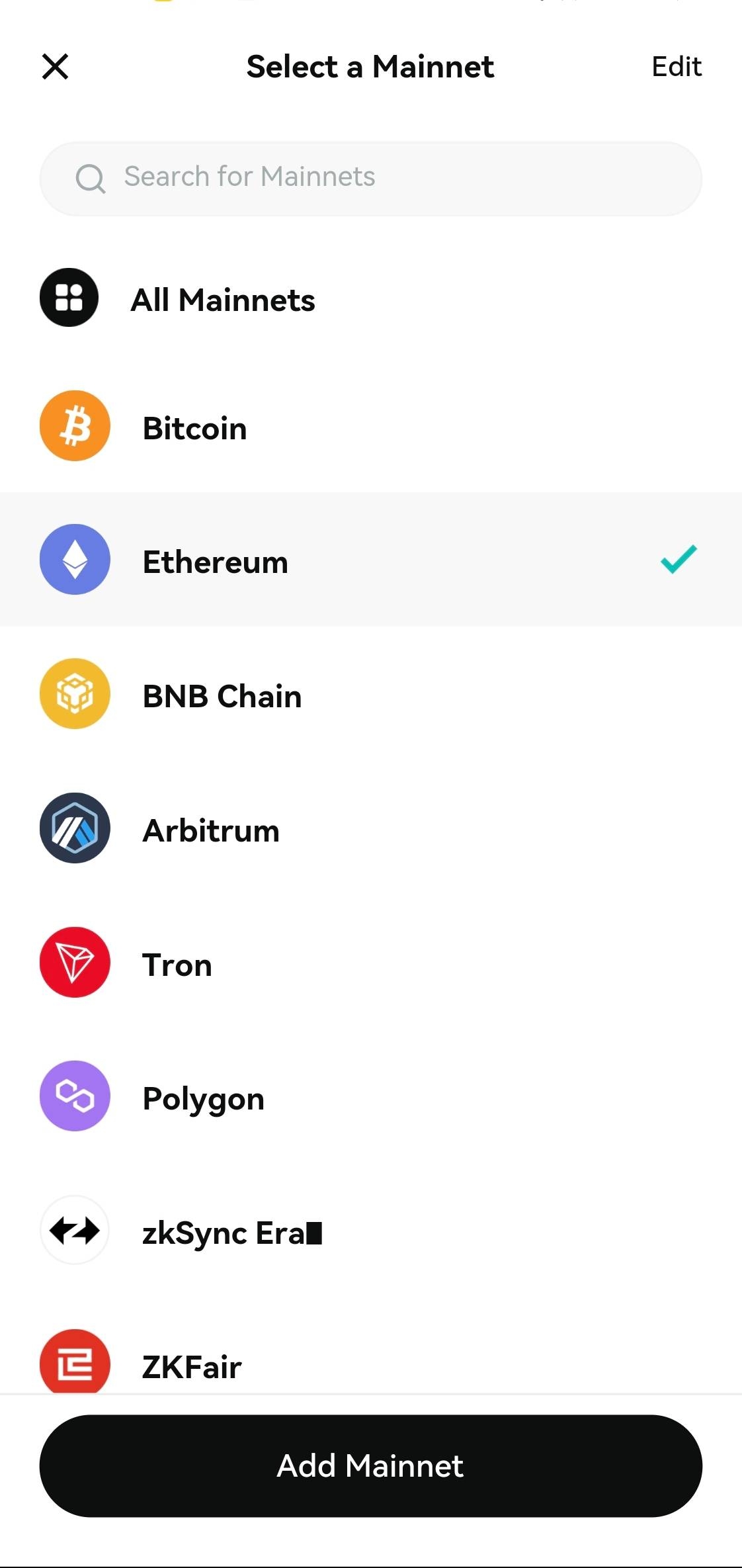

- 2. Choose to “Add a mainnet”

- 3. Choose “Ethereum Chain”

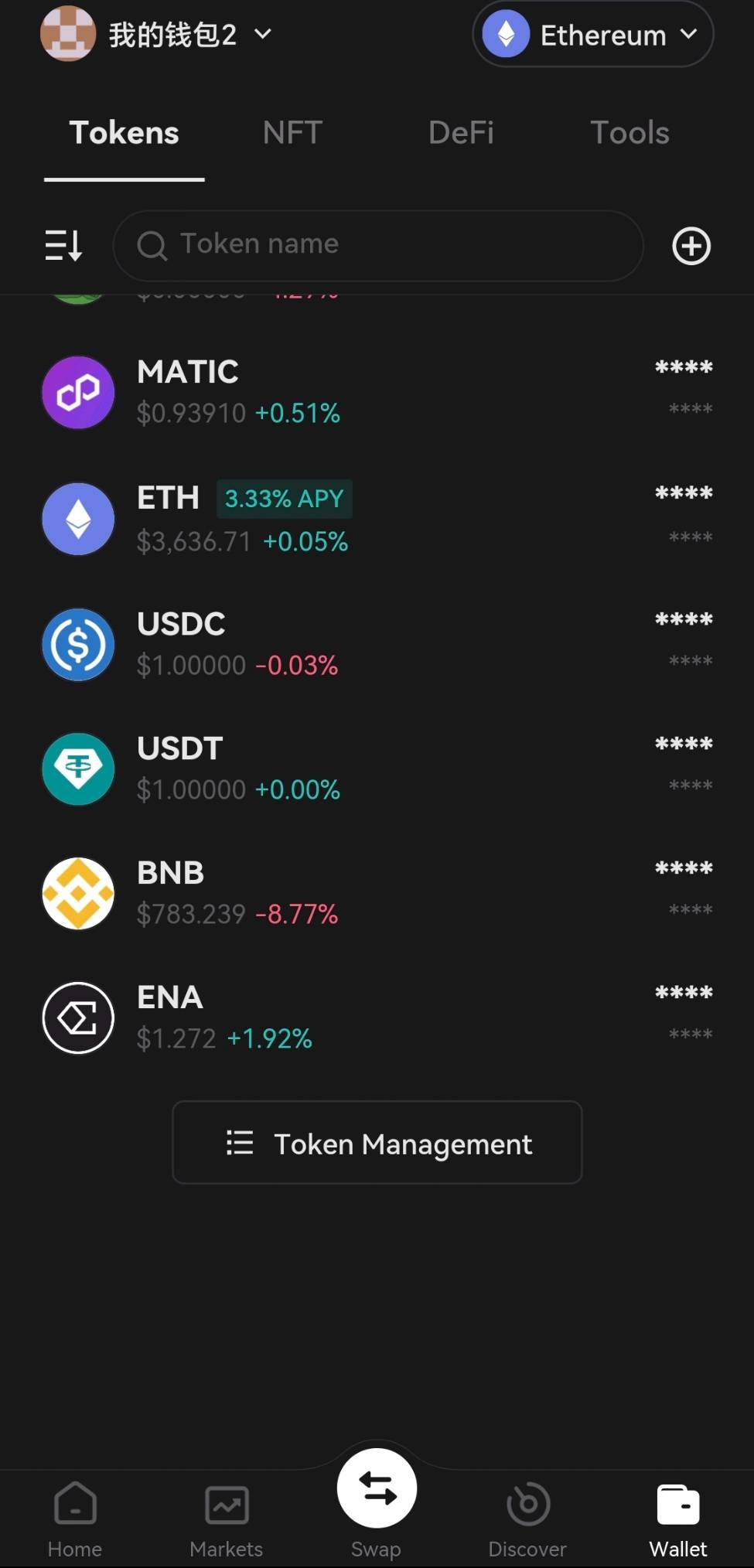

- 4. Return to the home page of Bitget Wallet to view the added mainnet and its native token

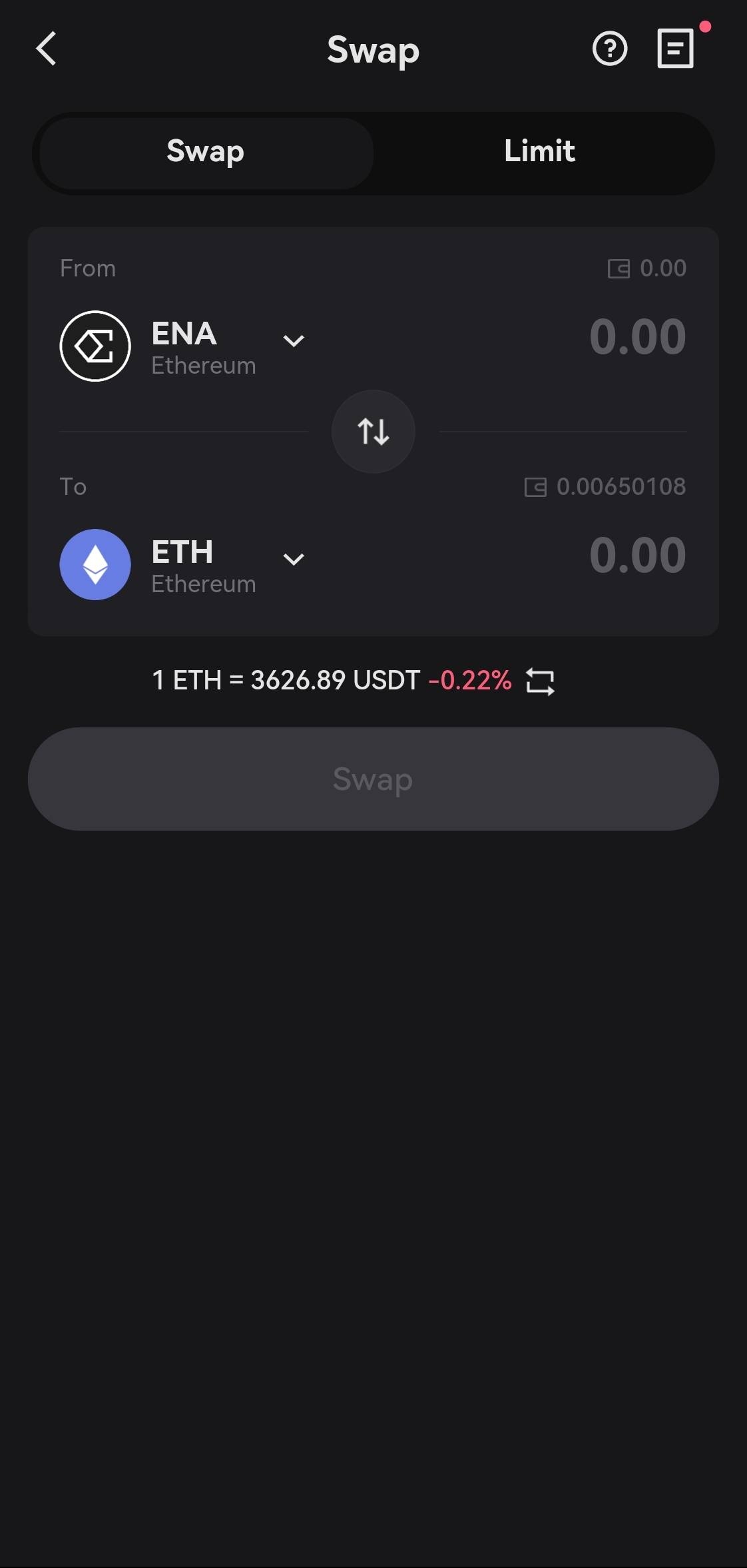

You can also use our OTC feature to buy USDT/USDC with Fiat currency and then swap for other tokens.

Ethena(ENA) Wallet Features

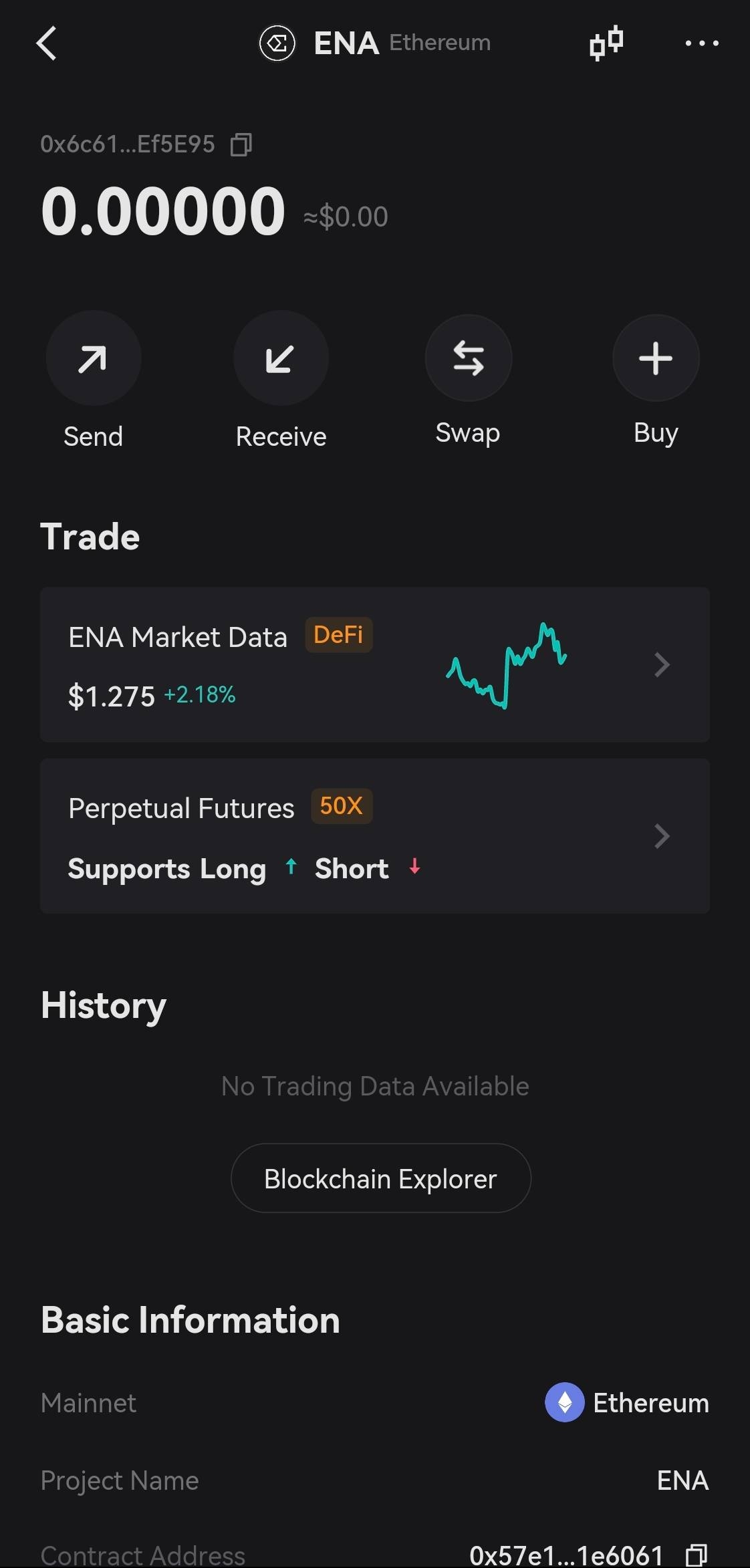

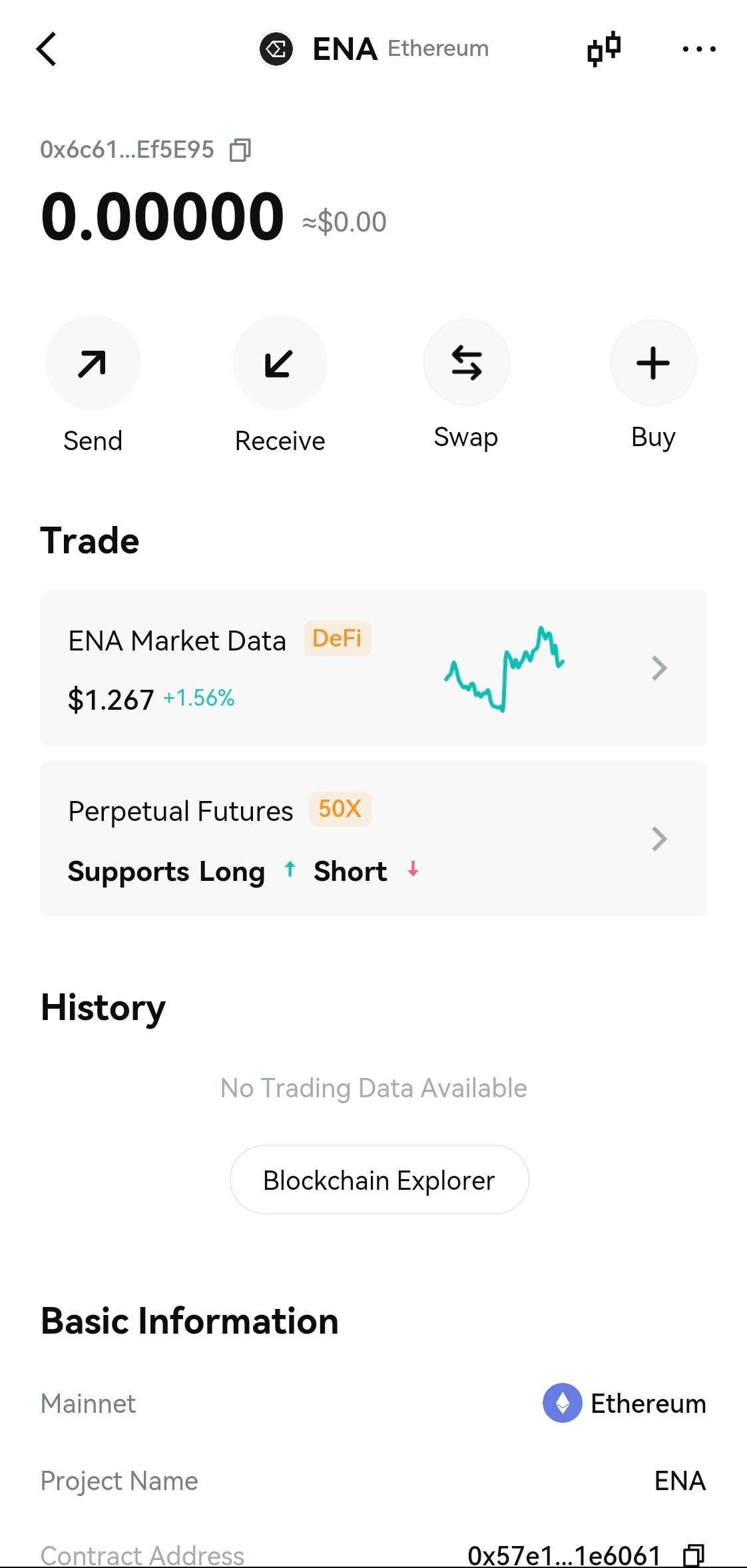

Swap on Ethena(ENA) Wallet

Bitget Wallet Swap has the most inclusive ENA market intelligence, including Real-time Quote, Token Price Chart (Daily, Weekly, Monthly, and Yearly Chart), Token Contract, Market Cap, Circulating Supply, Holders, Transaction Histories, and Data Analysis. You may also find the Bitget Wallet’s InstantGas Swap handy, especially for new ENA Wallet users, as it does not require users to hold the native token (ENA) to swap for other tokens.

Bitget Swap पर जाएं

FAQ

How to buy Ethena (ENA) ?

What's the best Ethena (ENA) Wallet?

How do you download Bitget Wallet and create an Ethena (ENA) Wallet?

About Ethena (ENA) Wallet

What is Ethena?

Ethena is a decentralized synthetic dollar protocol built on the Ethereum blockchain. It aims to provide a censorship-resistant, scalable, and stable form of digital money known as USDe. Unlike centralized stablecoins like USDC or USDT, USDe is generated by staking Ethereum (ETH) as collateral within the Ethena system. This decentralized approach offers an alternative for users seeking financial tools outside of traditional banking and regulatory structures. Ethena has its own governance token, ENA, which plays a crucial role in maintaining USDe's stability and influencing the protocol's direction. Ethena positions itself within the broader DeFi (Decentralized Finance) landscape, allowing USDe to be used for lending, borrowing, yield generation, and other DeFi strategies.

What makes Ethena unique?

Ethena stands apart within the stablecoin and DeFi sectors due to several key features. Firstly, it champions decentralization, allowing users to mint USDe using ETH as collateral. This approach aims to reduce reliance on centralized financial institutions, potentially increasing censorship resistance, and offering more transparency into how USDe maintains its stability. Ethena's use of a synthetic dollar model is another differentiating factor. It strives to maintain USDe's peg to the US dollar through algorithms, collateralization, and the involvement of its governance token, ENA. This approach differs from both traditional fiat-backed stablecoins and the often-volatile algorithmic stablecoins of the past. Additionally, Ethena's emphasis on community-driven governance empowers ENA holders to directly participate in shaping the protocol's future through proposals and voting. This aligns it with the growing emphasis on decentralized decision-making within the DeFi space. Furthermore, Ethena's focus on DeFi integration allows USDe to be used for lending, borrowing, yield generation, and interaction with various DApps, positioning it as a potentially versatile tool for DeFi users. While these elements give Ethena a unique edge, it's crucial to remember that the concepts of synthetic stablecoins and decentralized governance are still evolving. Ethena's long-term success hinges on maintaining USDe's stability, the effectiveness of its underlying mechanisms, and its ability to foster a strong and active community.

What is the future potential of Ethena?

Ethena's future potential is intertwined with the broader evolution of both stablecoins and the DeFi landscape. If the demand for decentralized, censorship-resistant financial tools continues to grow, Ethena could find a significant niche. Its focus on maintaining USDe's stability, while prioritizing decentralization, might resonate with users seeking an alternative to traditional stablecoins. Additionally, Ethena's community-driven governance model could attract those who value having a voice in how the protocol they use develops. The success of its integration with various DeFi platforms will also play a major role – the more use cases for USDe, the greater its potential adoption. However, Ethena faces several challenges. The stability of synthetic assets remains a concern, as past projects have demonstrated that maintaining consistent pegs can be difficult. The regulatory landscape surrounding stablecoins is also evolving, which could impact Ethena's operations. Additionally, competition in both the stablecoin and DeFi sectors is fierce. Ethena will need to continuously innovate and adapt to remain relevant in a fast-paced environment. Overall, Ethena's future holds both promise and uncertainty. The growing interest in decentralized financial tools and its emphasis on community involvement could propel it forward. However, maintaining USDe's stability, navigating the regulatory landscape, and standing out within the highly competitive DeFi space are crucial hurdles it must overcome to achieve long-term success.

Which crypto narrative does Ethena leverage?

Ethena primarily draws its strength from two core crypto narratives. Firstly, it's deeply rooted in the ongoing DeFi revolution. By providing decentralized financial tools, empowering users to interact with the Ethereum DeFi ecosystem using USDe, and emphasizing community-driven governance, Ethena positions itself at the forefront of the movement to decentralize traditional financial structures. Secondly, Ethena participates in the reimagining of stablecoins. It offers a decentralized alternative to centralized options, seeking to provide greater transparency, potential censorship resistance, and increased user control within the stablecoin space. Additionally, Ethena subtly touches upon emerging narratives focused on algorithmic assets and the power of decentralized governance. Depending on its long-term success or failure, it may even play a role in shaping the future direction of these narratives.