How to Earn Passive Income via Crypto

How to Earn Passive Income from Crypto - You Don't Have to Trade Daily. Most people think you need to spend your whole day trading to make money with crypto. But the truth is you can earn a good income from your crypto by staking, lending, yield farming and other ways, without having to lift a finger. In this article we're going to explain what crypto passive income really is, give you our top tips on how to earn more from your crypto and how to pick a secure platform to work with (we'll even cover how to earn some extra cash using the Bitget Wallet) so you can start building a steady income.

Key Takeaways

- There are loads of ways to earn passive income from crypto - you can stake, lend, farm yields, get involved with NFTs, and plenty more.

- When you're choosing a platform to work with, security, fees and tax implications are just as important as the way you're earning.

- With a good wallet like Bitget Wallet you can keep track of all your rewards from across multiple chains in one place.

Why Are So Many People Earning Passive Income from Crypto?

It's starting to look like more than 40% of all crypto investors are now earning a bit of extra cash through staking or lending, rather than just buying and selling. That's a pretty big number, and it suggests just how quickly people are finding out that earning passive income with crypto is easy and accessible.

Here are the main types of passive income out there:

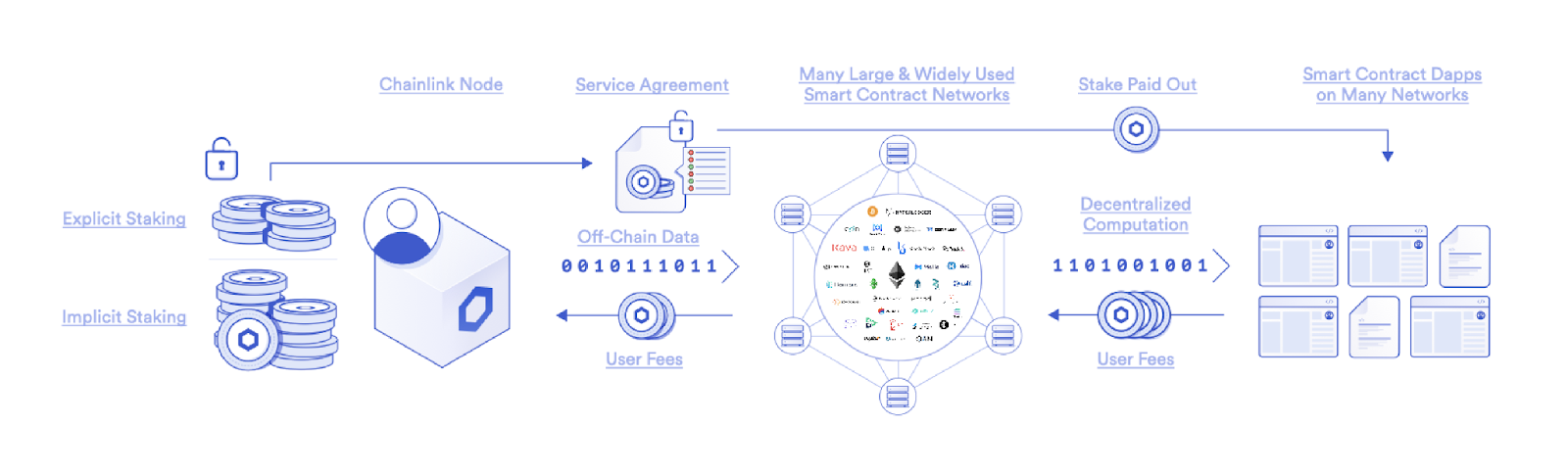

- Staking: basically locking up your tokens in a proof of stake network and getting some rewards in return.

Source: Chainlink

- Lending: putting your crypto out there so others can borrow it, while you get paid the interest.

- Yield farming: investing in liquidity on DeFi platforms to earn even more interest.

- NFT rentals / dividend tokens: holding onto NFTs that get you some royalties or a share in platform profits.

One of the things that makes crypto so attractive is that it's global and decentralised. With a smartphone or a wallet, you can set up and earn from just about anywhere.

Since crypto is global and decentralized, people can create income from crypto virtually anywhere from their smartphone or wallet.

Why this matters in 2026 :

- Decentralized earning will start to change an aspect of personal finance - you don't need a trading desk.

- Transparency ("on chain") in blockchain will allow investors more confidence in their earnings - you can see your rewards on chain.

What Makes Crypto Passive Income So Unique in 2026?

What makes how to earn passive income via crypto so appealing is that it works 24/7 — there are no market closing hours, no borders, and no intermediaries. Investors can earn rewards anytime, anywhere.

DeFi innovation keeps introducing new ways to earn — automated staking pools, NFT rentals, and yield boosters — allowing users to tailor returns to their own comfort level.

In short:

- Traditional markets rely on brokers; crypto removes them.

- Decentralization allows anyone to generate income from crypto freely and transparently.

What Are the Easiest Ways to Earn Passive Income via Crypto?

When exploring how to earn passive income via crypto, beginners should focus on simple, low-barrier methods that don’t require deep DeFi expertise. Below are the most accessible and proven strategies to start building consistent crypto passive income in 2026.

1. Crypto Staking

For crypto staking for beginners, staking is one of the most direct ways to learn how to earn passive income via crypto. It involves locking up digital assets like Ethereum, Cardano, or Polkadot to support their networks in exchange for rewards.

Pros: Easy setup, predictable yields, supports decentralization.

Cons: Lock-ups limit liquidity; token volatility affects returns.

2. Earn Interest Rewards from Crypto

Platforms such as **Bitget Wallet’s Earn Plus**, Coinbase, and Kraken make how to earn passive income via crypto as simple as depositing stablecoins like USDC and earning interest.

- Buy or deposit crypto.

- Opt into the earning program.

- Monitor rewards within your wallet.

It’s a hands-off way to earn while maintaining liquidity.

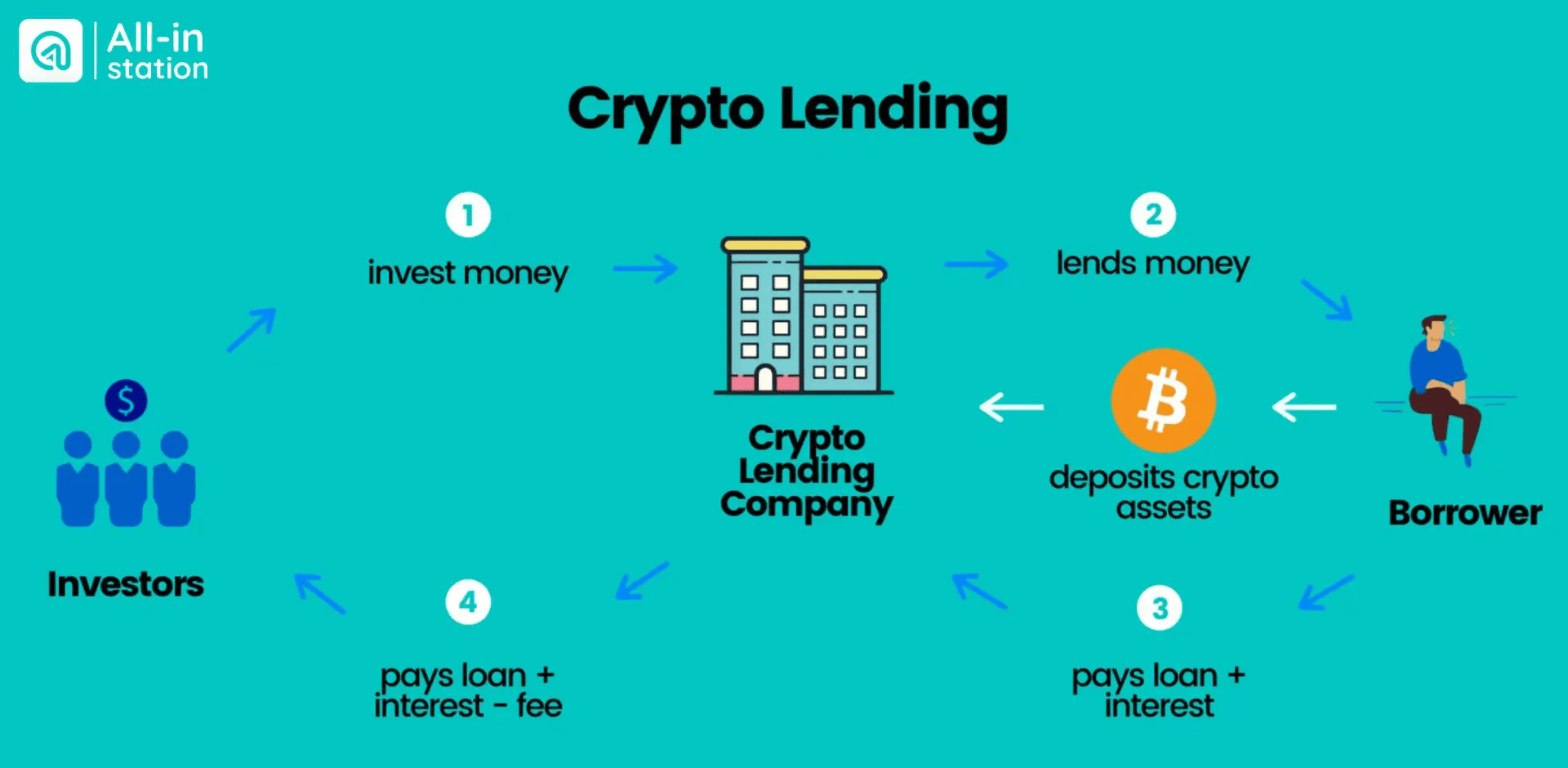

3. Crypto Lending

Crypto lending remains one of the best-known ways of how to earn passive income via crypto through CeFi or DeFi platforms like Aave and Compound. By lending assets to borrowers, you earn interest with variable APYs.

Ensure you check whether loans are collateralized and platforms audited — essential for reducing counterparty risk.

Source: Allinstation

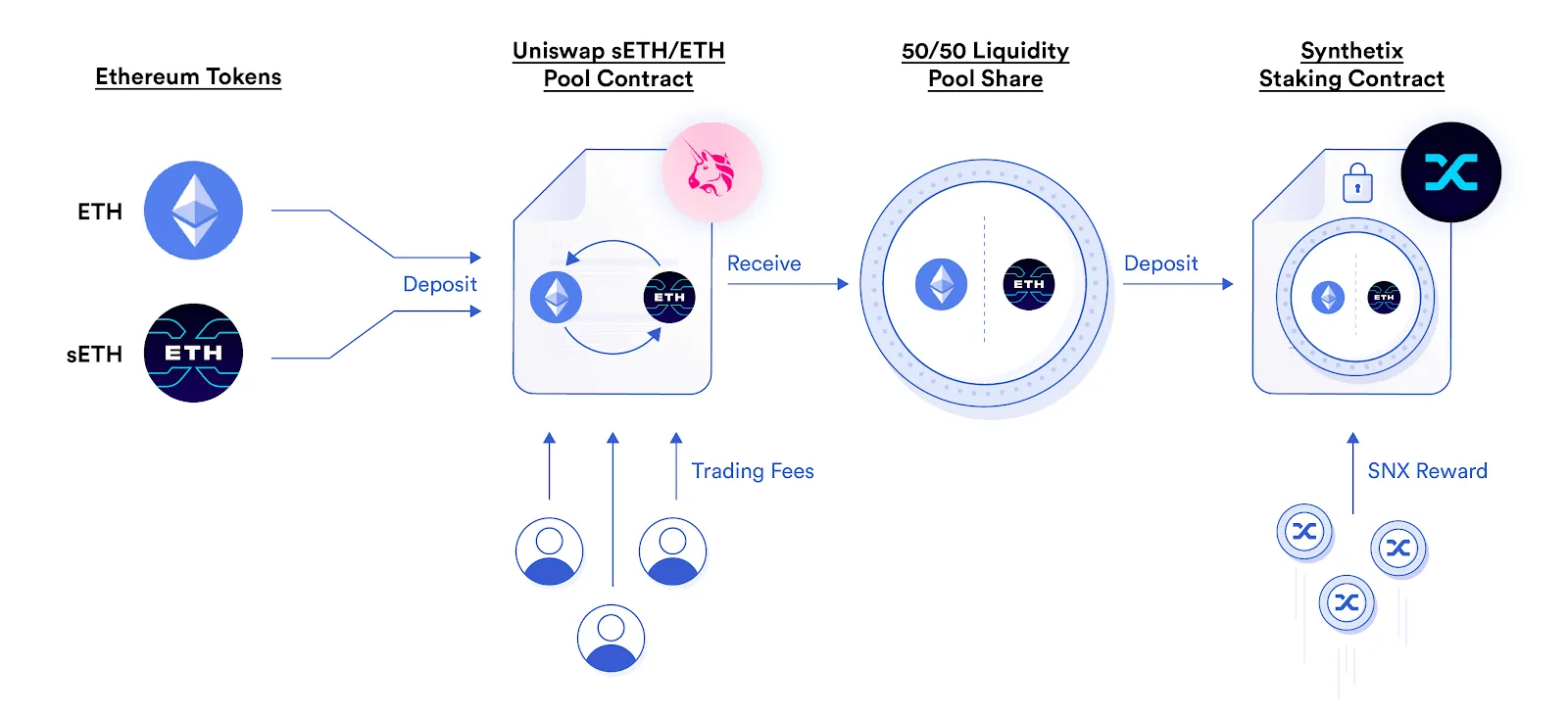

4. Yield Farming

Yield farming combines staking and lending for higher returns. Platforms like Lido and Curve showcase how to earn passive income via crypto by compounding yields through governance tokens. It’s lucrative but carries risks like impermanent loss and contract vulnerabilities.

For example, a user might stake ETH through Lido, deposit the resulting stETH into Curve, and then stake Curve LP tokens on Convex — effectively stacking multiple reward layers. However, this strategy requires a good grasp of smart contract risks and potential impermanent loss when asset prices shift.

Source Chainlink

5. Liquidity Pools

In decentralized exchanges like Uniswap and SushiSwap, users can add funds to liquidity pools to enable token swaps. In return, they earn a share of the trading fees generated by those swaps. Each contributor receives LP tokens representing their share of the pool.

Liquidity provision is an essential part of DeFi but comes with risks — notably impermanent loss, which occurs when token prices move significantly after you’ve deposited them. Gas fees on some blockchains can also eat into profits, so timing and platform choice matter.

6. Dividend-Earning Tokens in Crypto

Some cryptocurrencies and exchange-based assets act like digital dividends. Tokens such as KuCoin Shares (KCS), AscendEX (ASD), or NEO distribute a portion of platform profits or network fees to holders. These dividend-earning tokens allow investors to earn passive income without trading.

Compared to stock dividends, the concept is similar — holders benefit from the project’s growth. However, returns depend on the platform’s success and market volume. This strategy is best for users who prefer long-term holding over short-term trading.

7. NFTs

Non-fungible tokens (NFTs) have also evolved beyond collectibles. Some protocols now support NFT staking or rental models, such as reNFT or NFTX, enabling users to earn tokens by locking up or lending out their NFTs. In gaming ecosystems, players can rent out characters or virtual assets to other users and share in-game earnings — a trend often called play-to-earn crypto games income.

Still, NFT-based income streams are volatile and less liquid than other options. Market demand, game popularity, and platform reliability all influence the returns, making it a more speculative choice compared to staking or lending.

What Should You Consider Before Choosing a Crypto Passive Income Platform?

Choosing where to earn your crypto passive income is just as important as deciding which method to use. With so many platforms offering high yields, investors must look beyond flashy APYs and carefully assess security, reputation, and transparency before depositing funds. A good platform balances attractive returns with sustainable operations and responsible risk management.

One of the most critical distinctions is between CeFi (Centralized Finance) and DeFi (Decentralized Finance).

- CeFi platforms like Celsius or BlockFi once promised easy passive income but collapsed due to poor risk controls and mismanagement.

- DeFi protocols, on the other hand, let users retain control of their assets through smart contracts, though these can also introduce technical vulnerabilities.

A reliable strategy is to diversify between both — using CeFi for simplicity and DeFi for transparency — while always verifying audits, security track records, and on-chain metrics.

Here’s a simple checklist to guide your platform selection:

- Reputation and Security – Research user feedback, audit results, and company background. Avoid platforms with unclear ownership or opaque fund management.

- Centralized vs. Decentralized – Decide whether you prefer a regulated service (CeFi) or non-custodial autonomy (DeFi).

- Liquidity and Lock-up Terms – Understand how easily you can withdraw your funds and whether staking or lending involves lock-up periods.

- Tax Compliance and Reporting Tools – Choose services that simplify tax tracking and integrate with software like Koinly or CoinLedger. This is especially useful since crypto income strategies are increasingly subject to global tax laws.

- Transparency on Yields – Legitimate projects disclose where returns come from — whether from staking rewards, loan interest, or trading fees.

Is Passive Income via Crypto Taxable in 2026?

As the crypto market matures, tax authorities worldwide are catching up — and yes, crypto passive income is taxable in most jurisdictions. Whether you’re earning rewards through staking, lending, or liquidity pools, those gains are often treated as ordinary income. However, the exact rules depend on where you live and how your crypto earnings are classified.

In general, tax offices divide crypto income into two major categories:

- Ordinary Income: Rewards earned through staking, lending, or yield farming are typically considered regular income, taxed at your marginal rate at the time you receive them.

- Capital Gains: When you later sell or swap your earned tokens, the profit or loss from that transaction may fall under capital gains tax.

Since regulations are still evolving, it’s best to stay updated on local guidance and track every transaction carefully.

How Is Crypto Passive Income Taxed in Different Situations?

Different income types lead to different tax treatments. For example:

- Staking Rewards: Taxed when received, based on fair market value.

- Interest Income (CeFi/DeFi): Considered ordinary income, similar to savings interest.

- Yield Farming or Airdrop Bonuses: May count as income upon receipt, and capital gains upon disposal.

- NFT or Game-Based Earnings: Subject to variable treatment depending on local tax laws and whether the assets are classified as collectibles or securities.

Keeping detailed transaction logs helps reduce errors and ensure compliance.

How Can Investors Simplify Their Tax Reporting?

Managing crypto tax reports can be challenging, especially with multiple wallets and DeFi platforms involved. Thankfully, tools like Koinly, CoinLedger, and Blockpit now integrate directly with exchanges and wallets, automatically calculating income and capital gains.

If you’re using Bitget Wallet, exporting transaction data or using portfolio trackers can help you stay organized for tax filing. The key is to categorize your earnings early — don’t wait until tax season.

How Can You Safely Maximize Your Crypto Passive Income Returns?

Generating consistent returns in crypto doesn’t just depend on chasing the highest APY — it’s about managing risk, diversifying strategies, and using secure tools. Whether you’re staking, lending, or yield farming, smart allocation and regular monitoring are among the best ways to earn crypto income sustainably.

What Are the Safest Strategies for Beginners?

For newcomers, starting with staking or interest-bearing stablecoins is often the safest route. These methods offer predictable yields and minimal technical barriers. Stablecoins like USDC or USDT reduce volatility while still generating steady returns. Always prioritize platforms with proven security records and transparent audits.

How to Diversify Without Overexposure

A core part of learning how to earn passive income via crypto safely is understanding diversification. Spreading funds across several earning strategies—like staking, lending, and liquidity pools—helps balance returns and reduce exposure to market shocks.

Here’s how to diversify smartly:

- Mix stable and volatile assets: Use stablecoins (USDC, USDT) for reliable yields, while allocating a smaller portion to higher-yield assets such as DeFi or NFTs.

- Choose platforms across ecosystems: Don’t keep all funds in one blockchain or provider. Explore different ecosystems like Ethereum, Solana, or BNB Chain for broader exposure.

- Reinvest cautiously: Compound earnings, but avoid overleveraging or “chasing” double-digit APYs that may be unsustainable.

Diversification isn’t just about earning more—it’s about protecting your long-term ability to generate income from crypto no matter how the market shifts.

What Tools Help You Track and Optimize Earnings?

To truly master how to earn passive income via crypto, investors need visibility. Tracking tools and wallets play a vital role in keeping records of yields, lock-ups, and compounding performance.

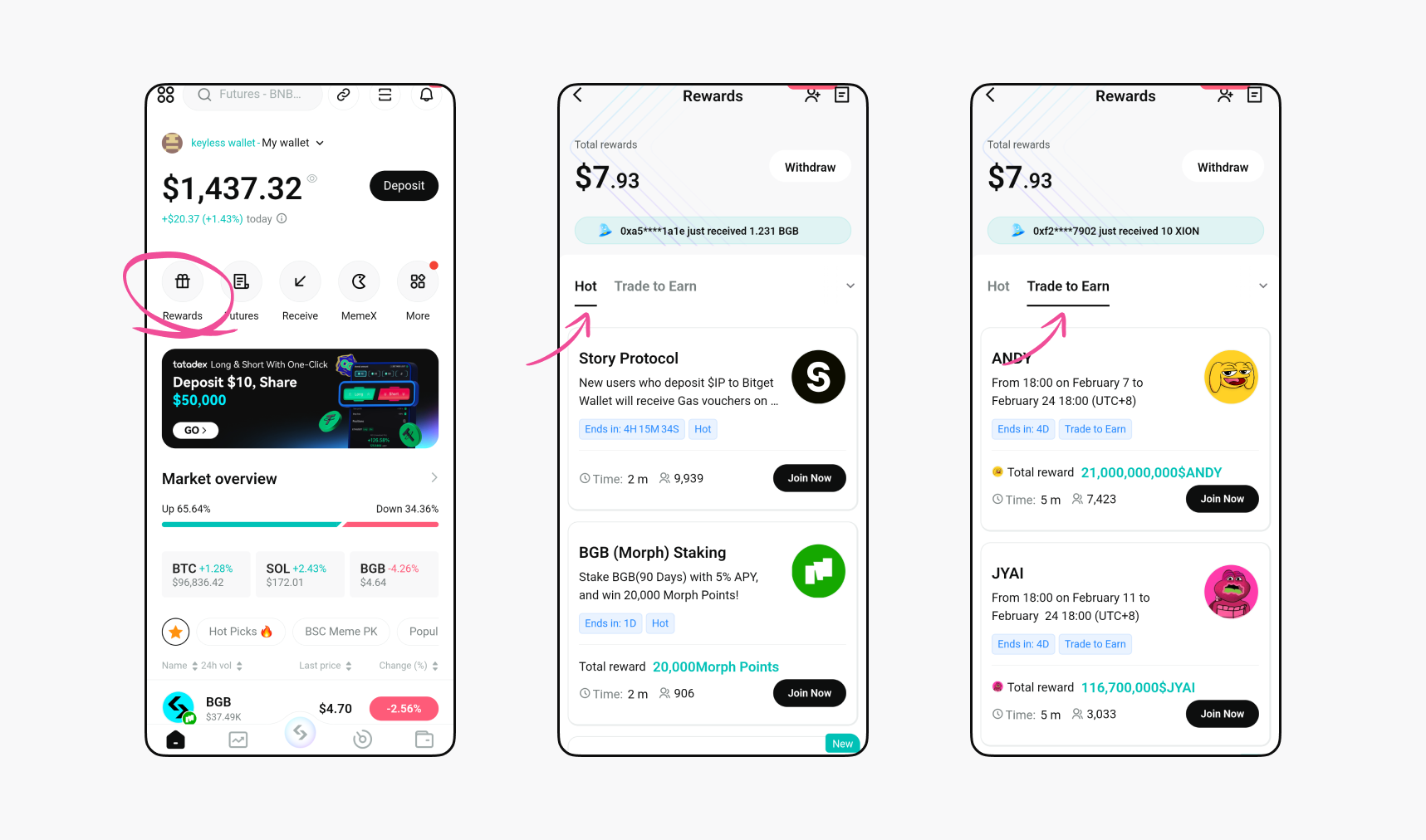

Bitget Wallet, a leading multi-chain wallet used by over 80 million users worldwide, offers built-in portfolio tracking and real-time analytics. It supports over 130 blockchains and 1 million tokens, enabling users to manage assets, claim staking rewards, and monitor DeFi returns all in one place.

- Consistent tracking = smarter compounding decisions.

- Security + visibility = steady long-term returns.

With clear insights and seamless DeFi integration, Bitget Wallet helps investors strengthen their crypto income strategy—safely and efficiently.

How to Earn Passive Income via Crypto Using Bitget Wallet?

As the DeFi landscape grows, managing multiple assets and protocols can be overwhelming. That’s where Bitget Wallet stands out — an all-in-one gateway for earning, managing, and securing your crypto income.

Why Choose Bitget Wallet for Passive Income?

Bitget Wallet supports staking, lending, and yield farming across major chains such as Ethereum, Solana, and BNB Chain. It also offers zero-fee memecoin trading and secure stablecoin storage, making it ideal for users looking to balance safety with profitability.

Unlike traditional custodial wallets, Bitget Wallet gives users full control of their assets while integrating directly with top DeFi protocols. Whether you’re a beginner or an experienced investor, it simplifies the entire process of earning and compounding rewards.

How to Start Earning with Bitget Wallet

- Download Bitget Wallet from the official site or app store.

- Deposit or swap tokens for supported earning assets.

- Select an earning option:

- Stake tokens to receive consistent yields.

- Join liquidity pools to earn trading fees and bonuses.

- Use Stablecoin Earn Plus for rates up to 10% APY.

- Track and manage rewards in real time with built-in portfolio analytics.

Bitget Wallet’s unified dashboard makes it easier to monitor your passive income across all networks — giving you a clear picture of your overall performance.

Read more:

- How to Earn Passive Income With Cryptocurrency? A Beginner’s Guide

- sUSDS Passive Income Guide: What Is $sUSDS and How to Earn with 4.5% Yield

- How to Earn Passive Income with Ripple ($XRP): Best Crypto Investment in 2025?

Conclusion

Learning how to earn passive income via crypto is one of the most empowering steps for modern investors looking to grow their wealth beyond traditional finance. From simple staking and interest rewards to more advanced strategies like lending and yield farming, the crypto ecosystem offers multiple paths to steady, compounding returns.

Still, success in passive income investing depends on choosing trustworthy platforms, understanding risks, and diversifying wisely. Whether you prefer the stability of staking or the flexibility of DeFi yield farming, consistency and caution remain your strongest tools.

👉🏻With Bitget Wallet, you can manage stablecoins, explore DeFi opportunities, and earn passive income — all in one secure app. Start building your crypto income today with the wallet trusted by over 80 million users worldwide.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What does passive income mean in crypto?

Passive income in crypto refers to earning rewards or returns without actively trading. Investors can earn by staking, lending, joining liquidity pools, or holding dividend-paying tokens. These strategies allow users to generate income from crypto automatically, often through blockchain-based reward systems.

2. How much can I earn from crypto passive income?

Earnings depend on the method and market conditions. Staking and lending can generate between 5%–15% APY, while yield farming or NFT-based income may offer higher but riskier returns. Always balance your portfolio between high-yield and stable opportunities.

3. Is crypto passive income safe?

Safety depends on the platform’s security, transparency, and reputation. Using verified protocols and multi-chain wallets like Bitget Wallet helps reduce risks. Avoid platforms promising unrealistic or “guaranteed” returns, as these often carry hidden dangers.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Invest in Cryptocurrency: A Beginner's Guide for 20252025-11-03 | 5 mins

- How to Pay with Crypto for Everyday Purchases — From Bills to Travel2025-10-09 | 5 minutes