How to Invest in Cryptocurrency: A Beginner's Guide for 2025

How to invest in cryptocurrency safely and profitably in 2025? Cryptocurrency investing involves purchasing digital currencies like Bitcoin or Ethereum and holding them for potential long-term growth.

Crypto investing for beginners has become incredibly accessible in 2025. Anyone can start entirely from your phone with as little as $10 without needing Wall Street connections or thousands of dollars upfront.

This article explains all steps from storage setup to getting your opening crypto and handling danger well. Bitget Wallet provides newcomers a safe and multi-chain system to hold stablecoins and swap popular tokens through networks. Discover the proven methods that help newcomers prevent costly errors and build wealth safely.

Key Takeaways

- Digital currencies provide remarkable profit chances with constant trading access and rising global acceptance. Bitcoin generated 26,931% gains across ten years, as leading corporations worldwide now support crypto transactions.

- Understanding how to invest in cryptocurrency involves three main strategies: buy-and-hold for long-term growth, dollar-cost averaging to reduce risk, and staking to generate passive income through blockchain participation.

- Crypto investing for beginners requires avoiding FOMO buying, ignoring security practices, and overtrading without strategy. Wait 24 hours before major purchases, use secure wallets, and stick to investment plans.

Why Should You Consider Investing in Cryptocurrency?

Cryptocurrency has grown from a risky test into a legitimate money-building tool available to anyone with internet access.

Potential for High Returns and Portfolio Growth

Bitcoin produced remarkable gains of 26,931% over ten years from 2014 to 2024, changing a $100 buy into $26,931. While past results never promise coming outcomes, they show cryptocurrency's profit-making power for lasting owners.

On the other hand, traditional investments pale for beginners exploring growth opportunities. Understanding how to invest in cryptocurrency helps investors evaluate these different asset classes effectively.

| Asset Class | 10-Year Return (2014-2024) | 5-Year Return |

| Bitcoin | 26,931% | 1,284% |

| S&P 500 | 193% | 97% |

| Gold | 126% | 85% |

24/7 Market Access and Global Opportunities

Cryptocurrency markets operate continuously, unlike traditional markets limited to weekday business hours. This structure allows investors to respond instantly to global events, economic news, and market movements regardless of time zone or location.

Anyone with internet access can participate in cryptocurrency markets without geographic restrictions or minimum thresholds. This trait further democratizes investing and enables cryptocurrency trading vs investing opportunities for millions of users.

Growing Adoption and Mainstream Acceptance

More than 15,000 businesses globally accept digital currencies today, with 2,300 American stores included, showing widespread money system integration. Large corporations embrace crypto assets for transactions, balance sheet holdings, and client payment options. Top firms pushing digital currency use include:

-

Microsoft:

Accepts Bitcoin for digital content purchases since 2014, pioneering corporate crypto integration in the technology sector.

-

Tesla:

Holds Bitcoin on its balance sheet and accepts cryptocurrency payments, demonstrating institutional confidence in digital assets.

-

PayPal:

Started "Pay with Crypto" allowing American sellers to take more than 100 digital coins via its worldwide payment network.

Big investors put major funds into crypto assets, with 59% planning above 5% wallet shares before 2025. This rule framework and seller support makes crypto investment a key factor for today's investors.

Source: Moneycontrol

How Do You Start Investing in Cryptocurrency as a Beginner?

Starting your cryptocurrency investment journey involves three essential steps: securing a wallet, selecting your first digital assets, and making your first purchase.

Step 1: Choose a Secure Cryptocurrency Wallet

A cryptocurrency wallet stores your private keys, the cryptographic codes proving ownership of your digital assets. Without safe wallet handling, you face total fund loss forever, since missing secret keys stay gone for good.

Learning how to buy cryptocurrency safely starts with picking the correct wallet kind. The best crypto wallets in 2025 provide different safety tiers and ease-of-use features matching varied requirements.

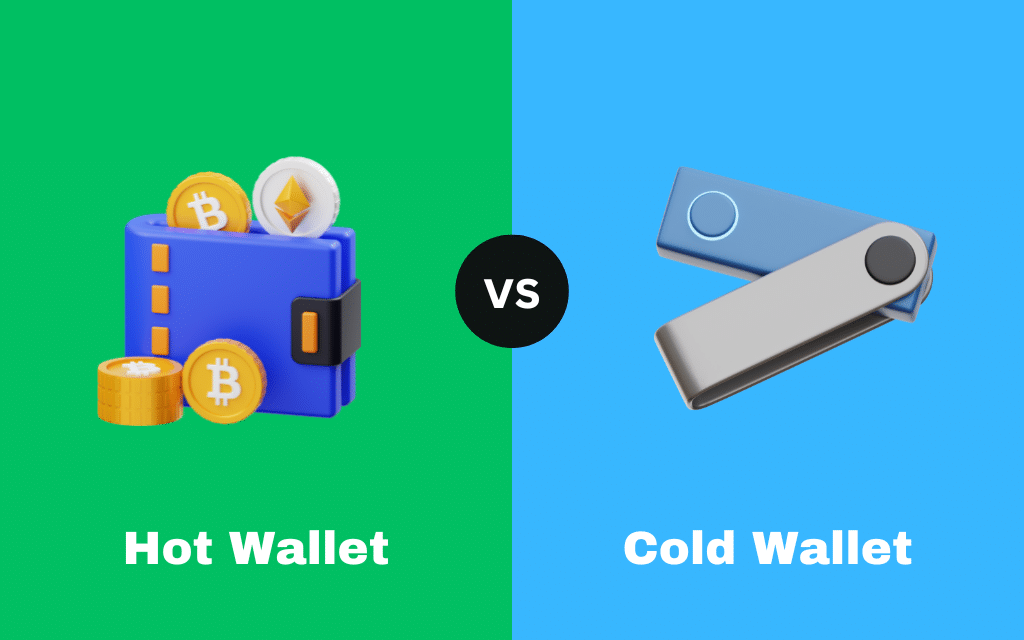

-

Hot Wallets (Internet-connected software wallets):

These wallets stay connected online, allowing quick entry for regular trades and busy buying through phone apps, web tools, or computer programs. They provide ease but encounter greater safety threats.

-

Cold Wallets (Offline hardware storage devices):

These solid devices keep secret keys fully offline, giving better protection from hack tries. They run $50-200 and fit lasting storage, while getting funds needs plugging in the device.

Source: CEP DC

Step 2: Select Your First Cryptocurrency

Bitcoin and Ethereum stay the top suggested starting points for newcomers given their proven track records and market control. How to start investing in Bitcoin and Ethereum usually means splitting amounts between both.

Stablecoins, such as USDT and USDC, hold a fixed $1 worth via dollar backing, offering price steadiness for trades and short-term storage through market swings. Learning how to invest in cryptocurrency means knowing about steady choices.

Source: Trust Machines

Step 3: Make Your First Purchase

The crypto buying method is simple and usually needs only minutes after you pick a trusted exchange site.

-

Pick an exchange:

Choose beginner-ready sites with strong security features and regulatory compliance.

-

Create and verify account:

Complete registration with personal information and identity verification as required by financial regulations.

-

Fund your account:

Deposit fiat currency through bank transfers (lowest fees) or debit cards (instant but higher costs).

-

Place your order:

Select your cryptocurrency, choose market order for instant purchase, and confirm the transaction.

One tip is to start small to minimize risk while learning market dynamics. Most exchanges allow purchases as low as $10-50. After purchase, cryptocurrency appears in your wallet within minutes. Transfer to a personal wallet for enhanced security or keep on the exchange initially while building comfort with wallet management.

What Are the Different Ways to Invest in Cryptocurrency?

Crypto investment includes several methods fitted to varied risk comfort levels, time horizons, and market participation degrees, from passive holding to active yield earning.

1. Buy and Hold Strategy

The buy-and-hold method, often named "HODLing" in crypto communities, means buying tokens and keeping them for long periods despite short-term market swings.

Common timeframes span from three to five years, while many buyers stretch ownership past five to ten years. Using this method requires substantial emotional discipline, as positions may experience 50-80% drawdowns before eventual recovery and growth.

Source: Webopedia

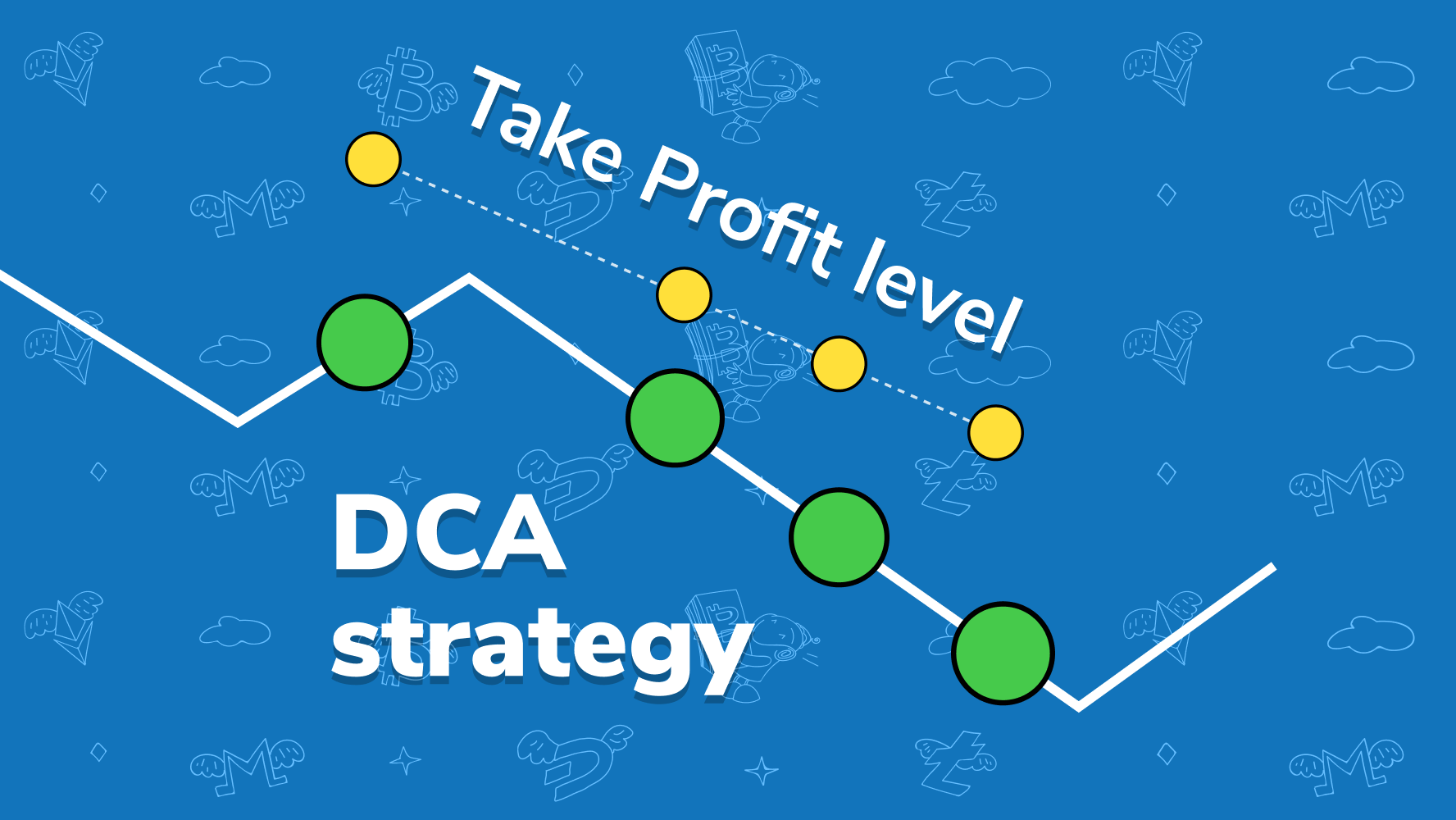

2. Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves acquiring a fixed dollar amount of tokens at consistent intervals, such as weekly or monthly, regardless of current price. This method slowly builds positions over time without trying to time market entry points.

DCA cuts risk by lessening price swing effects and taking out emotional choices from the buying process. This method spreads buys across many price levels and creates a smaller average cost per coin versus lump-sum buys at possibly bad prices.

Source: Trade Santa

3. Staking and Yield Generation

Staking lets crypto owners lock their coins backing proof-of-stake blockchain systems in trade for getting rewards, much like getting interest on regular savings accounts.

This action creates passive earnings on holdings that would otherwise stay unused, changing fixed holdings into earning-producing coins. Annual percentage yields typically range from 5-21% for established cryptocurrencies, with platforms often automatically compounding rewards to accelerate growth.

Yet, there are important risk factors that beginners must be aware of when learning how to invest in cryptocurrency:

-

Market Volatility Risk:

Earning 10% APY means nothing if the asset's price declines 20% during the staking period, resulting in net losses despite reward accumulation through yield generation.

-

Lockup Period Restrictions:

Many staking arrangements prevent withdrawals for weeks or months, eliminating the ability to respond to market opportunities or sell during downturns and market corrections.

-

Platform and Smart Contract Risk:

Flaws in contract code, safety breaches, or site hacks may cause part or full loss of locked coins, mainly with fresh systems giving strangely high returns.

Source: SOMA.Finance

How Can You Manage Risk When Investing in Cryptocurrency?

Strong crypto risk handling is key for guarding money and reaching lasting wins in one of the globe's most unstable asset types.

Portfolio Diversification Strategies

Diversification distributes buying power through several digital coins instead of piling holdings in one single asset.

-

Avoid single-asset concentration:

Never allocate all funds to one cryptocurrency. Even Bitcoin experiences significant volatility with drawdowns exceeding 50% from peak values, making concentration unnecessarily risky.

-

Mix large-cap and stablecoins:

Pair Bitcoin and Ethereum for growth potential with USDT or USDC for steadiness, building balanced portfolios that handle market swings well.

-

Follow allocation guidelines:

Allocate 50-80% to large-cap cryptocurrencies, 10-30% to mid-cap altcoins, and 10-20% to stablecoins for optimal risk-adjusted returns and liquidity management.

Security Best Practices

Learning how to buy cryptocurrency safely begins with protected storage using combined methods. Keep 70-90% of assets in cold storage tools like Ledger or Trezor, holding secret keys fully offline.

Protected crypto buying also requires never keeping secret keys digitally in web storage, login tools, or photos. Write seed phrases exclusively on durable physical materials stored in geographically separate secure locations, and enable two-factor authentication on all accounts to strengthen cryptocurrency risk management practices.

Setting Investment Limits

Only investing what you can afford to lose stands as the single most important rule of cryptocurrency investing. This principle becomes critical in cryptocurrency markets that can experience double-digit percentage drops within hours.

Buying limits must guarantee crypto allocations come only from spare money, with most advisors suggesting 5-10% of total investment portfolios. Placing stop-loss orders at 15-30% below entry prices offers protection from major losses while accommodating market swings.

Emotional discipline via advance-set plans stops fear-based decisions during market drops, separating winning lasting buyers from people who face crushing losses from crypto risk handling mistakes.

What Are Common Mistakes to Avoid When Investing in Cryptocurrency?

New investors often slip into expected pitfalls that cause major money losses and mental strain. This part shows frequent errors to help crypto buyers prevent facing setbacks.

1. FOMO Buying and Emotional Decision Making

Fear of Missing Out (FOMO) in digital currency pushes buyers to purchase coins rashly when watching fast price jumps. This feeling becomes extra strong in unstable crypto markets, where values can climb sharply within hours through social sites and trading groups.

To prevent FOMO-driven choices, pause 24 hours before big buys to build needed mental space between feeling triggers and buying choices. Also, do complete research during pause times instead of responding to short-term buzz.

2. Ignoring Security and Wallet Protection

Common security mistakes include using weak passwords, sharing private keys or seed phrases with others, and clicking suspicious phishing links. These lapses result in total permanent fund loss, exchange hacks, and wallet-targeting attacks with no recovery possibility. Some best practices to protect investments include:

-

Implement hybrid wallet strategy:

Keep 70-90% of assets in cold storage hardware wallets holding secret keys fully offline. Apply hot wallets just for tiny trade sums, handling them like bills in your real wallet.

-

Enable two-factor authentication:

Turn on 2FA for every crypto account right away through phone authenticator apps like Google Authenticator. This extra shield stops unwanted entry even when login codes are stolen.

3. Overtrading and Lack of Strategy

Overtrading means too much buying and selling without solid plans, pushed mainly by feelings and sudden urges instead of logical study. Several costs pile up fast when overtrading:

-

Transaction fees:

Every trade incurs exchange fees (0.1-0.5%), network gas fees, and spread costs that consume profits and guarantee long-term losses.

-

Emotional stress:

Nonstop market watching builds worry, blocks smart choices, leads to exhaustion, and sparks addiction-type actions like problem gambling.

-

Poor returns:

Studies show most quick traders drop money over time as higher trading speed links with higher danger levels and piled-up fees.

To counter this error, be sure to follow your buying plan by writing strategies with set entry rules, exit goals, and bet size limits. Plus, skip nonstop checking by viewing prices just once each day or week.

How Does Bitget Wallet Help You Invest in Cryptocurrency Safely?

Bitget Wallet stands among the best crypto wallets 2025, offering a beginner-friendly solution for managing digital assets securely.

1. Multi-Chain Support Across Major Networks

Bitget Wallet supports over 130 blockchains, including Ethereum, Solana, BNB Chain, Base, and Polygon, enabling seamless cross-chain asset management from a single interface. Users can store tokens on multiple networks and transfer assets instantly without juggling separate wallets.

2. Secure Stablecoin Storage and Management

With full support for USDT and USDC, Bitget Wallet secures stablecoin holdings through non-custodial MPC technology and hardware-grade encryption. The wallet also protects stable assets across EVM and non-EVM networks, thus eliminating vulnerabilities common in less secure alternatives.

3. Built-In Swap Function for Instant Trading

The built-in DEX aggregator routes token swaps across supported chains in one click, finding the most efficient liquidity paths for trades. Learning how to trade cryptocurrency becomes accessible as users swap tokens instantly with competitive fees without leaving the wallet interface or dealing with external exchanges.

4. Real-Time Portfolio Tracking and Price Monitoring

Bitget Wallet's joined control panel gives a full collection view with current price data and result measures watching complete asset worth, each-token splits, and trade shifts in live time. This tool helps buyers make smart choices via nonstop sight into portfolio performance and market conditions.

5. Access to DeFi and Staking Opportunities

Built-in DeFi features permit straight entry to top systems for yield farming, lending, and staking chances. Buyers can stake coins like ETH, SOL, or stablecoins to gain passive gains of 8-10% APY, showing how to invest in cryptocurrency with profit while controlling all tasks from inside one safe platform.

6. Beginner-Friendly Interface and User Experience

Built for fresh users in focus, Bitget Wallet leads buyers through basic setup steps covering seed-phrase or MPC keyless wallet picks, backup safety, and two-factor checks. The easy-to-use UI keeps key tools within reach, reducing learning curves for those exploring the best crypto wallets in 2025.

Download Bitget Wallet to manage stablecoins and trending tokens across chains in one beginner-friendly app. Bitget Wallet demonstrates how secure multi-chain support, instant swaps, and integrated DeFi access create the ideal application for starting your cryptocurrency investment journey safely.

Conclusion

Learning how to invest in cryptocurrency with wins needs picking newcomer-ready coins, handling danger via collection spreading, and keeping calm during price swings.

Beginning your buying path starts with getting a trusted storage tool for virtual coin keeping. Bitget Wallet stands as a leading pick for fresh users, giving multi-chain backing, protected stablecoin handling, and quick token trades through main networks.

Get Bitget Wallet to handle stablecoins and hot tokens through chains, all inside one newcomer-ready tool. Crypto buying for fresh users turns simple when pairing safe storage setup with live collection watching and built-in DeFi options for bold buying.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How much money do I need to start investing in cryptocurrency?

You can begin investing in crypto with as little as $10–$50 on major exchanges thanks to fractional purchases, though $100–$500 offers a more meaningful stake and diversification potential.

2. What is the best cryptocurrency to invest in for beginners?

Learning how to start investing in Bitcoin and Ethereum makes these large-cap assets ideal for beginners, offering liquidity, established track records, and wide accessibility across exchanges and wallets.

3. How do I store my cryptocurrency safely?

Safe storage pairs hardware cold storage, coded backups of seed words, and self-custody answers like Bitget Wallet, using MPC coding, 2FA, and multi-chain backing to guard your crypto coins.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Earn Passive Income via Crypto2025-11-03 | 5 mins

- How to Pay with Crypto for Everyday Purchases — From Bills to Travel2025-10-09 | 5 minutes